Walmart on Thursday announced layoffs affecting approximately 200 employees in its Bethlehem, Pennsylvania, fulfillment center. Earlier in the week, Amazon CEO Andy Jassy announced that the e-commerce giant would cut 9,000 jobs, the latest in a string of layoffs.

Something’s happening in e-commerce, but it’s difficult to disentangle all of the data: Census Bureau numbers on seasonally unadjusted e-commerce retail sales were up 6% year over year (y/y), but they’re only current as of the fourth quarter of 2022. Recall that sales figures can benefit from inflation: Higher prices mean higher total sales numbers, even if consumers aren’t making as many purchases. Understanding the slowdown in e-commerce fulfillment center construction and hiring and the subsequent pivot to workforce contraction requires a volume metric, not a sales metric.

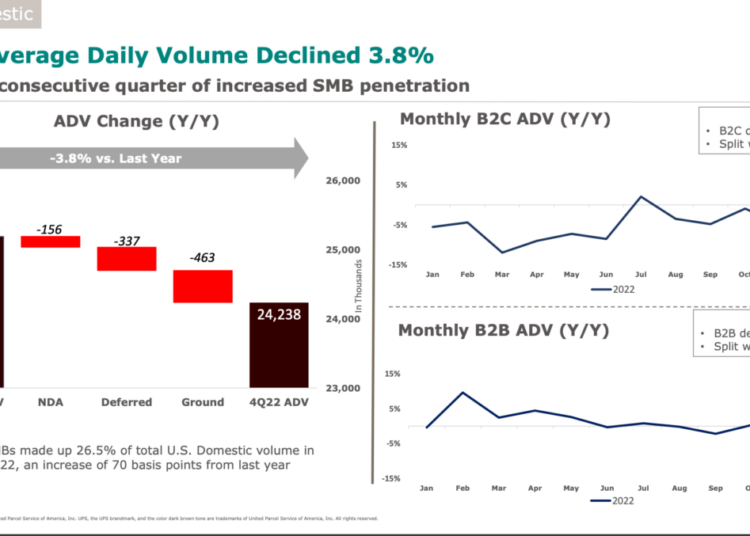

There’s some evidence that e-commerce volume growth is slowing significantly. UPS was already seeing a drop in domestic parcel volume in the fourth quarter of 2022 — business-to-consumer volumes were down 3% y/y and business-to-business volumes were down 5.2% y/y.

(Charts: UPS earning presentation.)

Meanwhile, demand for cardboard boxes is plunging, seemingly confirming that American consumers are making fewer online purchases and parcel integrators are handling fewer packages.

During the question-and-answer portion of Walmart’s earnings call in February for the fourth quarter of fiscal year 2023, CEO Doug McMillon made a telling comment about the retail giant’s margin structure that points to a troubling, ongoing shift in consumer behavior.

“If you look over the last 12 months, we had a mix shift in our business from [general merchandise] to food and consumables of over 300 basis points,” McMillon said. “And we actually don’t expect that to improve this year. In fact, we expect it to get a little bit worse — not by the same magnitude, but slightly worse.”

Earlier in the call, during management’s prepared remarks, Chief Financial Officer John David Rainey had already flagged the effect that inflation was having on consumers: Walmart shoppers were buying less general merchandise and more food, health and wellness consumable items. Not only were customers spending their money on food rather than durable goods, but the data indicated they were increasingly making downmarket or inexpensive choices. The growth in grocery itself was coming from newer high-income customers, not typically considered Walmart’s target market.

“We continue to see strong share gains in grocery, with nearly half coming from higher-income households,” Rainey said. “And private brand penetration increased over 160 basis points as customers prioritize value.”

So there’s a complex set of shifts in consumer behavior: people choosing food and essentials over durable goods, higher income customers shopping more at less expensive grocery stores, and grocery customers in general buying more private label than name-brand foods. Each of those three trends, it seems, is being driven by inflationary pressures on consumer wallets: Their dollars just aren’t going as far, so they’re making thriftier choices.

Truckload tender data in the FreightWaves SONAR platform reveals how this mix shift occurred during 2022.

(Van outbounder tender volume index in white, reefer outbound volume tender index in blue. Chart: FreightWaves SONAR. To learn more about FreightWaves SONAR, click here.)

The chart above compares percentage changes since a year ago in dry van (white) and temperature-controlled (blue) truckload tender requests. The chart makes comparing the relative growth in volume of the two equipment types easy. For example, it’s clear that while refrigerated volumes were underperforming van in the first part of 2022, beginning that summer, reefer was taking share from van and first crossed above van in September 2022. In the first quarter of 2023, reefer volumes have outperformed dry van volumes, though both are down.

That reefer truckload volumes are holding up better than dry volumes also confirms what Walmart’s management discussed on the earnings call: that food is outperforming general merchandise. Although Walmart’s e-commerce business is growing, e-commerce volumes as a whole are flat to down.

What does this mean for transportation providers, consumer brands and retailers? Food-centric Laredo, Texas, which handles 38% of Mexico’s exported produce, is gaining market share against retail-centric Los Angeles.

(Change in market share of outbound tender volume in Laredo (white) compared to Los Angeles (green). Chart: FreightWaves SONAR. To learn more about FreightWaves SONAR, click here.)

Softer e-commerce growth might actually be good for some transportation companies, like parcel integrator FedEx, which reported third-quarter fiscal year earnings on March 16. Although volumes were down across the company, from express to ground, international and freight, management has begun rightsizing the business, improving yield, and it actually raised earnings guidance for 2023.

(Charts: FedEx earnings presentation)

The charts above, from FedEx’s earnings presentation, present a stark picture: double-digit year-over-year volume declines.

“We are rightsizing our cost base to match today’s realities and creating a more efficient and agile network,” said FedEx CEO Raj Subramaniam. “We’re not simply taking out cost. We are simultaneously focused on running our business more efficiently, flexibly and profitably, which will create significant value for our stockholders in the years to come. I’m particularly pleased with the progress we are seeing in Ground. The team has taken aggressive actions to address its cost structure and has effectively mitigated volume pressures.”

Beginning nearly three years ago, a higher proportion of business-to-consumer shipments created margin headwinds for UPS and FedEx as cheap e-commerce packages flooded their networks. But what goes up must come down: Now, even though the overall revenue picture isn’t exactly blue skies for FedEx revenue, which is overindexed to air cargo, a leaner operation and a more favorable mix shift will improve the margin picture.

So despite significant volume softness, last week Subramaniam raised FedEx’s guidance on total 2023 adjusted earnings per share to $13.80 to $14.40, up from $12.50 to $13.50 previously. FedEx stock jumped 12% on the positive guidance.

The post Is inflation crushing e-commerce volume growth? appeared first on FreightWaves.