With the benchmark price used for most fuel surcharges dropping for a ninth consecutive week, diesel buyers might want to savor the decline while they can. With the shocking news that hit oil markets over the weekend, the future course is likely to be higher.

The Department of Energy/Energy Information Administration average weekly retail diesel price effective Monday was $4.105 a gallon, a decline of 2.3 cents. The price is now down $1.236 a gallon since its most recent high of $5.341 a gallon on Oct. 24. Prices have declined in 19 of the 23 weeks after that.

The DOE/EIA price also is down $1.705 a gallon from its all-time high of $5.81 on June 20.

But on the same day the decline was posted, futures prices across the oil complex soared on the unexpected news over the weekend that the OPEC+ group, which includes OPEC and a group of non-OPEC oil exporters led by Russia, had agreed to cut output by 1 million barrels a day. The reductions are to go into effect in May and last through the year.

In a Bloomberg article with a compilation of analyst comments about the change, few held back on the significance of the move. “Any unexpected 1 million barrel per day change in supply or demand conditions over the course of a year can impact prices between $20 and $25 per barrel,” Francisco Blanch, head of commodity and derivatives research at Bank of America, was quoted as saying.

Blanch added a theme heard often in oil markets in recent weeks: The U.S. shale patch is having tremendous difficulty in increasing its output and is challenged to increase supply as prices increase. “OPEC is no longer afraid of a major U.S. shale oil supply response if Brent crude oil prices trade above $80 per barrel, so cutting volumes to push oil prices higher does not carry the same risks it did five years ago,” Blanch said.

Goldman Sachs, which had recently reduced its target price for global benchmark crude Brent by the end of the year on the back of woes in the banking sector, moved it right back up following the OPEC move. Its forecast for December is now set at $95 a barrel, up from $90 previously.

Those comments come on top of a quarterly report by the Federal Reserve in Dallas on the state of the oil patch, and it laid out the same scenario: It’s gotten tough for U.S. oil producers to increase output.

“Growth in the oil and gas sector stalled out in the first quarter of 2023,” the Dallas Fed quarterly survey said. The business activity index was 2.1 in the first quarter, down from 30.3 in the fourth quarter of 2022, which the Fed said “indicates activity was largely unchanged from the prior quarter, a break from the more than two-year stretch of rising activity.”

One of the reasons for the decline, according to the Fed: increased costs. “Firms reported rising costs for a ninth consecutive quarter as all series remained significantly above their averages,” the report said.

The across-the-board increases in petroleum futures prices Monday saw diesel lag. That has been the trend for several weeks, evidenced most clearly in what has occurred since March 17. On that day, ultra low sulfur diesel on the CME commodity exchange settled at $2.6787 a gallon. On Monday, the settlement was $2.6626, a decline of about 1.6 cts a gallon.

But benchmark crude Brent settled Monday at $84.93 per barrel, compared to a settlement of $72.97 a barrel on March 17. That is an increase of more than 16%, compared to a ULSD performance of a slight decline.

Diesel prices have lagged Brent as there is growing concern about a recession that could hit demand. As an industrial fuel, diesel is often hit harder by a slowdown than gasoline. Weak trucking markets are potentially contributing to the decline in diesel prices, and that weakness is showing up in demand figures.

The EIA’s report on U.S. distillate product supplied — a proxy for demand of all nonjet distillates, about 90% of which is diesel — came in for the week ended March 24 at 3.713 million barrels a day. The average fourth week EIA report in that category for the prior seven years is 4.069 million barrels a day.

Another factor in the final retail price for diesel is its spread against wholesale prices. The rapid market decline in futures prices over the past six months resulted in retail lagging those sharp declines in the futures and wholesale markets.

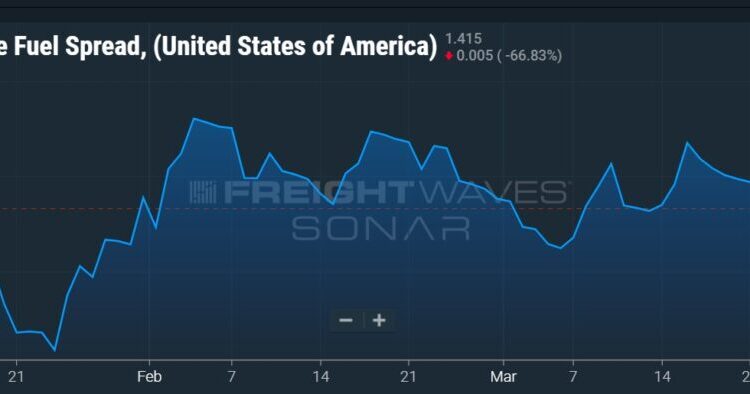

The FUELS.USA data series in SONAR topped out at $2.245 a gallon on Dec. 8, following the first few weeks of big declines in ULSD on CME, meaning average retail prices were that much higher than average wholesale prices.

ULSD traded above $4 a gallon several times in October before starting to move downward. But retail prices did not fall as fast, resulting in the blowout FUELS number. At $1.41 a gallon Monday, the price is still significantly above the range of $1 to $1.10 per gallon where FUELS tended to normalize before the Russian invasion of Ukraine scrambled markets.

If there is now a sharp move upward in futures prices as a result of the OPEC+ move, the retail price of diesel, if it follows historical precedence, is not likely to rise as fast, moving the FUELS.USA number more toward that $1-to-$1.10 spread.

More articles by John Kingston

Port of Oakland terminal’s prospect as A’s stadium site advances

California gets EPA waiver to move ahead with Advanced Clean Trucks rule

‘State of Freight’ for March: Bullish signs amid mostly bearish news

The post As oil market braces for higher prices, diesel benchmark drops again appeared first on FreightWaves.