Less-than-truckload carrier XPO is benefiting from an industrywide capacity shake-up. The company said it may ramp up planned terminal and equipment additions to meet the higher level of demand.

On its second-quarter call with analysts Friday, the company said demand troughed in March, improved in April and May but ticked lower in June. However, by the start of July, volumes were up year over year (y/y), and that was before shippers started moving freight away from Yellow Corp. (NASDAQ: YELL) en masse.

XPO was handling 3,000 more shipments, a high-single-digit increase, by the end of July than it was in the beginning of the month. Troubles at Yellow accelerated on July 18 when its union workforce said it would strike over missed payments that would leave some employees without insurance. By Sunday, it had ceased all operations.

For the full month of July, XPO’s shipments were up 9% y/y and tonnage increased 4%. Both growth rates were 700 basis points better than the change rates logged in the second quarter (shipments up 2% and tonnage down 3%). Compared to June, both metrics were 3% higher, which was 600 bps ahead of normal seasonal changes.

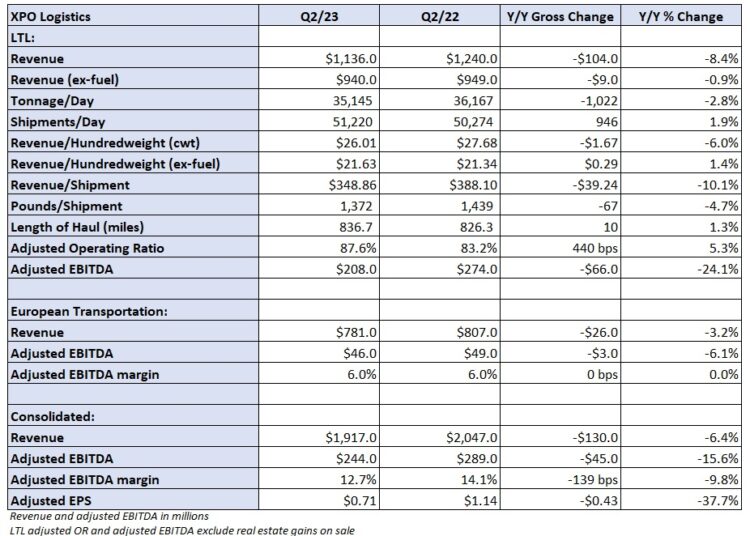

XPO (NYSE: XPO) reported second-quarter adjusted earnings per share of 71 cents Friday before the market opened, 10 cents ahead of analysts’ expectations but 43 cents lower y/y. The number excluded transaction and restructuring costs.

The immediate tightening in LTL capacity is expected to provide “an overall yield and price acceleration,” according to CEO Mario Harik.

Revenue per hundredweight (excluding fuel surcharges) was up 1% y/y in the quarter and 3% higher than in the first quarter. The yield increases accelerated as the quarter progressed with the momentum carrying into July.

Contract renewals on core accounts produced 5% y/y increases, but given the recent shakeup the bar has been raised for that metric, management said. It also expects accessorial charges to stick better than they were earlier in the year. XPO also implemented a general rate increase on transactional, 3PL business, which it doesn’t do every year.

Management is calling for yields to move 3% higher y/y in the third quarter.

Table: XPO’s key performance indicators

More capacity needed to meet demand

XPO is looking at further capacity additions to meet the recent surge in demand. It ended the second quarter with 20% excess capacity in the network but that has been reduced to a mid-teen percentage in recent days. Most growth-oriented carriers like to add infrastructure ahead of the demand curve. Excess capacity of 20% to 25% is not uncommon for a company trying to take market share.

The company’s capital expenditures plan calls for investments equaling 8% to 12% of annual revenue, but management now expects to spend at or above the high end of that range.

The company has added more than 1,900 tractors and 8,000 trailers over the last 18 months. It planned to build 6,000 trailers at its production facility this year but that operation could ramp production to 7,500 units if needed.

A longer-term goal has been to add 900 new doors to the network. It opened six new service centers last year and has already expanded two terminals this year. Those plans may be increased as well.

The labor market is also cooperative, according to Harik. He said applicants per open position are up threefold y/y. The company could also tap outside truck capacity if needed.

“It’s tough to tell what the rest of the quarter is going to do. This is a very fluid situation at this point,” Harik said. “We’ll see how these numbers … shake out here for August and beyond.”

Other Q2 highlights

The adjusted operating ratio in the LTL unit was 87.6%, which was 440 bps worse y/y but in line with management’s guidance. Salaries, wages and benefits increased 620 bps as a percentage of revenue but were only 320 bps higher when excluding changes in fuel revenue. XPO implemented an annual wage increase on April 1, which took pay up low- to mid-single digits.

Head count productivity improved as shipments in the second quarter were up 2% but labor hours were down 2%.

The company continued to make progress on lowering purchased transportation expense. The expense line was down 310 bps y/y (490 bps lower excluding fuel). XPO continued to reprice contracts with third-party carriers as truckload rates remain depressed. It also lowered outside miles by 400 bps y/y.

The two expense lines were actually 170 bps lower y/y excluding fuel revenue.

The LTL OR normally deteriorates by 230 bps from the second to third quarter each year but given the recent demand inflection, management expects to outperform that progression rate by 100 bps this year.

The LTL unit reported adjusted earnings before interest, taxes, depreciation and amortization of $208 million, a 24% y/y decline. That was partially due to a decline in fuel surcharges as diesel prices fell approximately 30% y/y in the period.

XPO’s European transportation segment recorded a 3% y/y revenue decline to $781 million and a 6% adjusted EBITDA margin, which was flat y/y.

Shares of XPO were up 4.5% at 12:20 p.m. EDT on Friday compared to the S&P 500, which was up 0.6%.

More FreightWaves articles by Todd Maiden

Schneider National lowers 2023 guidance

Forward Air starting to see impact from Yellow’s exit

The post XPO to ramp up capacity to fill Yellow void appeared first on FreightWaves.