Will the Biden administration renege?

Last week in this newsletter, I discussed news that surprised me: The Biden administration reportedly had said it won’t invoke the Taft-Hartley Act to prevent or put an end to a strike by the International Longshoremen’s Association (ILA). I’m not sure I believe that, at least not if the strike lasts for an extended period. Containership lines estimate that each day of a strike would lead to five to 10 days of congestion and delays, with a compounding impact the longer a work stoppage persists.

The latest news from this week is that the United States Maritime Alliance (USMX) says it can’t get a meeting scheduled with the ILA and it believes that the ILA has already decided to strike.

I found this article from Sourcing Journal helpful in describing what happens if, in fact, Biden were to invoke Taft-Hartley to avoid an elongated strike. Here are my notes:

There is precedent for invoking Taft-Hartley – President George W. Bush did it in 2002 to stop the International Longshore and Warehouse Union strike.

If the Biden administration were to invoke it, next steps would be:

(1) Workers go back to work during an 80-day cooling-off period while negotiations are supposed to continue.

(2) Assuming there’s no agreement, within 60-75 days, the USMX would submit its best and final offer to the National Labor Relations Board (NLRB), which would vote on it.

(3) If the NLRB finds the offer acceptable, results are sent to the attorney general. If not, the president would recommend that Congress take action.

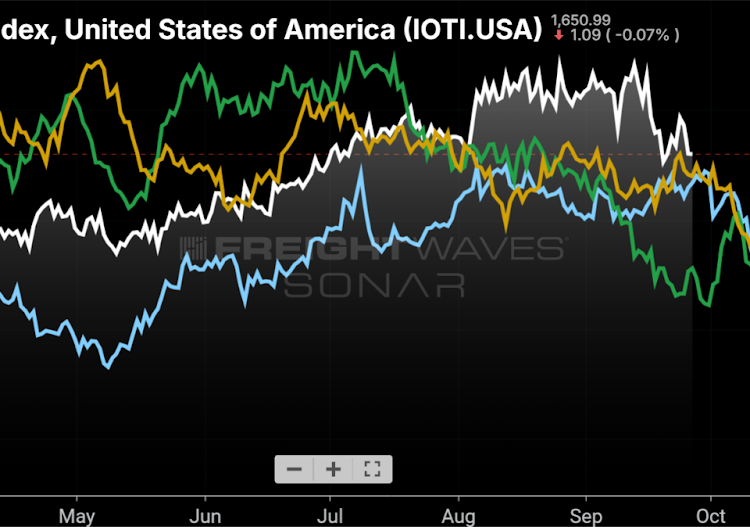

There was no pickup in ocean booking ahead of Golden Week, a Chinese holiday that takes place the first week of October. That suggests there really was a pull-forward of retail freight to earlier than seasonal norms, as some experts have suggested. (Chart: SONAR)

Check FreightWaves.com and the page of articles tagged with ILA for frequent updates. Here are the latest articles on the ILA:

Ports detail strike contingencies

Longshoremen port strike unlikely to hinder holiday retail season, expert says

Fear rises at FMC about possible East, Gulf Coast port strike

6 days until 45,000 East and Gulf Coast dockworkers could go on strike

2025 could be a very different year for the ocean market

Ocean spot rates have retreated gradually in the third quarter but remain at elevated levels following price shocks related to the Red Sea attacks and port congestion. (Chart. SONAR)

The ocean market has been one of the most volatile transportation sectors this year. In a webinar conducted earlier this week, Flexport made several points on the ocean market that I believe many do not fully appreciate.

The ocean carriers all have two sets of routing plans for two different scenarios: for an open and for a closed Red Sea. Illustrating the impact from longer routing around the Cape of Good Hope, Gemini Cooperation (Maersk and Hapag-Lloyd) has said it needs 300 vessels to satisfy its demand if the Red Sea is open and 340 vessels if it is not.

Two million twenty-foot equivalent units of capacity is scheduled to be delivered in 2025. The largest contributors are MSC and CMA CGM. On its most recent earnings call, Maersk estimated that capacity will grow 2%-3% per quarter.

Port congestion has constrained ocean capacity more than most people realize. Recent estimates suggest that 10% of the fleet is being absorbed due to congestion globally – and that is without any impact from the potential ILA strike.

The realignment of the ocean carrier alliances means each alliance has fewer carriers. That gives carriers more control over blanking sailings and taking other actions to manage capacity.

In short, the capacity coming into the market the next several quarters could lead to a looser ocean market, and that could really be exacerbated by less congestion at ports and/or the reopening of the Red Sea – which carriers are planning for even if they are not expecting it. Those impacts would be mitigated to an extent by carriers’ capacity management actions, such as blank sailings.

Roadtex lays out temp-controlled LTL game plan

(Image: FWTV)

On Monday’s The Stockout, Grace Sharkey and I interviewed Frank Hurst, EVP of less-than-truckload at Roadtex. Roadtex is a company owned by Echo that has a specialty in temperature-controlled LTL, particularly for freight that needs to be kept between 35 and 55 degrees fahrenheit. Industries served include food/grocery, confectionary and pharmaceutical.

Hurst recommends that CPG companies and big-box retailers leverage the expertise of a best-in-class logistics company to iron out the many complexities and pitfalls that come with moving temperature-controlled consumer goods. He believes that shippers should make more use of LTL shipment consolidation and direct shipping, which can improve efficiency and carbon emissions by reducing the number of touches as intermediate stops are eliminated. On the topic of avoiding on-time and in-full fees, Hurst recommends that CPG companies hire a logistics provider with experience screening for carriers with strong service track records.

View the episode here and check out the full The Stockout playlist here.

Union Pacific bolsters intermodal service offeringsSONAR: ORAILDOML.LAXCHI

At an investor conference last week, Western Class I railroad Union Pacific (UP) gave shippers an indication of how it plans to grow its intermodal franchise, which includes bolstering historically dense and also emerging lanes. Here are a few plans the railroad presented:

Bolstering its service in the LA to Chicago lane (volume shown above) by removing two days of transit time.

Doubling capacity at its Inland Empire intermodal facility.

Expanding with a Phoenix intermodal facility.

Adding on-dock intermodal service at the Port of Houston.

Expanding service from Mexico to the U.S. Southeast.

Adding lift capacity.

Adding a new Kansas City, Missouri intermodal terminal.

To a large extent, those items seem to be a competitive response to what we heard last year from J.B. Hunt’s Quantum program, which also added higher-service offerings and additional lanes via its partnership with BNSF. Nevertheless, the items UP discussed should make intermodal a stronger offering relative to long-haul truckload.

The post Where ILA strike might go from here appeared first on FreightWaves.