(A quick summary of Werner’s earnings can be found here.)

Equity analysts have sat in on enough earnings calls this quarter to have heard from plenty of C-suite executives who at best thought 2025 might be better than 2024 – and certainly weren’t popping any champagne corks.

Not surprisingly, it was the more optimistic tone of Derek Leathers, CEO of Werner Enterprises (NASDAQ: WERN), that caught the ear of analysts on the company’s Tuesday call.

Daniel Imbro, an analyst with Stephens, was upfront with Leathers about his projections.

“I think other CEOs this earnings season have been more mixed on peak season expectations,” Imbro said. “You mentioned big price opportunities and some underlying improvements.” Imbro asked Leathers what he was “seeing in the business that gives you confidence in a more normal peak season. Any more color on why you’ve been more bullish in the fourth quarter?”

The upbeat perception of Leathers’ statements could be discerned easily from his references to improving market conditions.

With that question, Leathers gently pushed back.

“I don’t want the read-through to be that I’m bullish on the fourth quarter,” he said. “I can’t speak to where others are coming from. But what I know is that in our customer base, we believe we’re going to have both a price and volume incremental life this peak season compared to last.”

“Obviously there are ongoing macro headwinds, and peak is only a small part of the overall organization,” he added, saying the fourth quarter would be a “mixed bag.”

Leathers said rate increases that Werner had been achieving as the company went from Q3 into Q4 were from clients who had been under “duress.” “So those numbers tend to be a little outsized, because that is freight that either needs to be repriced or replaced,” he said.

He offered no specific percentage numbers on the size of those increases, which he said came from “a level of assertiveness.”

Beyond that, Leathers said, “I think it’s too early to try to predict what 2025 looks like.” He added, “I think the next several weeks will really shape and tell us a lot about what to expect going into the formal bid season.”

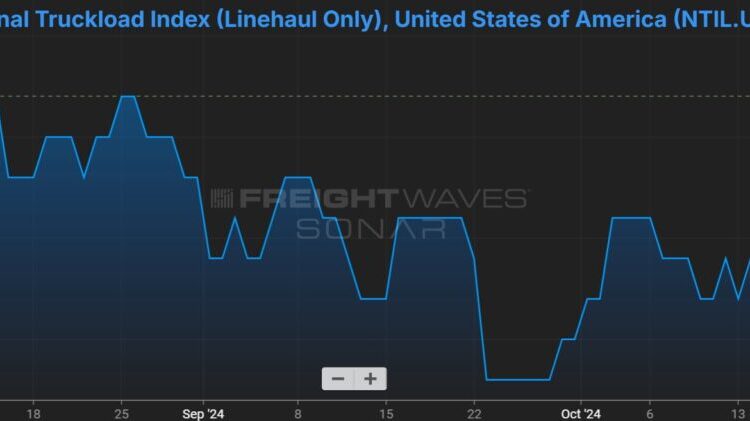

Outside factors have helped move freight rates higher, Leathers said. (The NTIL.USA freight rate in SONAR, representing the national average for linehaul only and no fuel charge, was $1.71 per mile Monday after being $1.64 per mile on Sept. 28.)

“What I can tell you is that the slow build that has been occuring in Q3 with some add-on in Q4 has been obviously somewhat impacted by natural disasters and the port strikes as well,” he said.

But it is more than that, he added. “There is an ongoing kind of subtle tightening taking place,” according to Leathers. “So I don’t want to call our shot just yet because I’d like to understand just how much tighter it gets as we go through this peak season.”

And in what might be viewed as a strong declaration, after years of a freight recession, Leathers said, “It is our expectation as we look into 2025 that the time for rates to be going up is upon us. The question is the magnitude, and I think it’s too early to tell.”

There were numbers in the third-quarter earnings suggesting an improvement at Werner.

For example, adjusted operating income for the Truckload Transportation Services segment at Werner was $24.5 million. While that was down 41.3% from a year ago, it was also up from the $21 million in the second quarter.

The operating ratio in the TTS segment was 94.7%. In the second quarter, it was 96.1%.

In the One-Way Truckload segment of TTS, average revenue per truck per week was $4,860 in the third quarter. That was up from $4,770 sequentially and $4,548 a year ago.

The Dedicated segment also had a small improvement in average revenue per truck per week. It came in at $4,563, just about 1.7% more than a year ago and up from $4,534 sequentially.

The overall weak market could be seen in the company’s total revenues of $754.7 million, which were down 9% from a year earlier. They also were down from $760.8 million sequentially.

Health costs hit the bottom line

It was operating income that took a significant hit, down 54% to $17.6 million. However, Leathers on the call said that was affected significantly by a surge in health care costs. He told analysts there was not one particular reason for the rise, because employee health records are confidential.

A 0.3% increase in revenue per total mile year on year was the first for that category in seven quarters, Leathers said.

In other highlights from the earnings call:

There may only have been approximately 16 workers at the New Jersey ECM subsidiary of Werner who voted last year to join the United Food and Commercial Workers union. But in a company of more than 13,000 employees, they have been getting an outsize amount of Leathers’ attention. When the drivers there were considering joining the union, Leathers personally visited with the New Jersey-based workers at the regional carrier acquired by Werner in 2021. And with the union having been decertified last month, Leathers took a victory lap on the earnings call, saying he was “pleased to report” about the decertification. Drivers at ECM in New Jersey “decided to work directly with company management in our ongoing effort to remain the best workplace for professional drivers.”

Werner has its own driving school. Its performance was cited by Werner management as one of the reasons for the weaker bottom-line numbers. Leathers said the school is a “true asset” but has “been one of the toughest areas over the last couple of quarters, because financially, it obviously underperforms in an area where if you’re shrinking your fleet, or even holding your fleet stagnant, that creates a cost overhang.” But Leathers said to cut back on the school would have been “a major strategic error.” About half its graduates join Werner, Leathers said, and the students who emerged from the school “perform better financially because of less bad debt and a lot less of other kind of negative issues.”

Post-close trading in Werner was negative following the results of the earnings. At approximately 6 p.m., Werner stock was down 3.42% to $37. The stock had been up about 5.3% in the past year but down about 2.5% in the past three months. Total company revenue of $745.7 million was less than the SeekingAlpha consensus estimate of $766 million. Net income of 9 cents per share was well below the SeekingAlpha consensus of 21 cents per share. But as Leathers and other Werner management stressed on the call, the net income figure was hit by factors other than a weak trucking market, such as the health care expense explosion.

More articles by John Kingston

TFI’s Bedard: Buying UPS’ LTL operations was not a mistake

Trucking and marijuana testing find their way to the Supreme Court

As Helene keeps key roads closed, Trimble’s routing service makes adjustments

The post Werner CEO stands out for optimistic trucking market outlook appeared first on FreightWaves.