As President-elect Donald Trump’s inauguration nears, uncertainty remains over how his tariffs and economic policies will affect business between the U.S. and its biggest international trade partners: Mexico, Canada and China.

Trump has repeatedly said he would slap tariffs as high as 25% on Mexico and Canada, along with an additional 10% tariff on Chinese goods.

“It’s very confusing right now. Trade between Mexico and the U.S. is growing, and our countries are very integrated,” Jorge Canavati, principal at J. Canavati & Co., told FreightWaves in an interview. “My concern is that the incoming government is going to use trade as an economic weapon, with all these threats, which is going to affect the United States quite a bit. It’s going to especially affect Texas.”

J. Canavati & Co. is a San Antonio-based company that provides international logistics and trade consulting. Canavati is on the board of various international trade organizations.

“Texas depends on Mexico, it’s one of our biggest suppliers. Mexico is also a big customer of Texas. So it’s a concern,” Canavati said.

In November, Mexico was the top U.S. trade partner at $69.2 billion in cross-border commerce, a 5% year-over-year increase from the same month in 2023.

It was the 11th consecutive month and 21st of the past 22 months that Mexico has been No. 1 in trade with the U.S.

Canada ranked No. 2 for trade with the U.S. at $64.4 billion in November, while China was third at $51 billion.

Related: US apparel importers scrambling after Mexico imposes tariffs

From January through November, U.S.-Mexico trade totaled $776.05 billion, a 6% year-over-year increase compared to the same period last year, according to the latest Census Bureau data.

Mexico is on pace to eclipse the $799 billion in two-way trade it achieved with the U.S. in 2023, boosted by exports of auto parts, gasoline, diesel engines and other fuels, as well as imports of commercial trucks, passenger vehicles, computers, auto parts and fresh produce.

Port Laredo, Texas, was the No. 1 U.S. trade gateway in November among the nation’s 450 airports, seaports and border crossings, according to Census Bureau data analyzed by WorldCity.

Port Laredo trade totaled $28.6 billion in November, a 9% year-over-year increase from the same period in 2023.

Chicago O’Hare International Airport ranked No. 2 at $27.9 billion, followed by the Port of Los Angeles at $27.7 billion.

Canavati said shippers have been frontloading freight from Asia to the U.S. in recent months in anticipation of increased tariffs once Trump takes office.

“Everyone is so scared that they’re pushing all their freight into the U.S. from Asia as quickly as possible. There’s two reasons for this: The first one is the Spring Festival, the Chinese New Year (Jan. 29), when China closes down all its factories for about a week. But the most important thing is freedom from the tariffs. People are pushing, pushing, pushing to get their freight here. Then what happens is that rates are rising fast,” Canavati said.

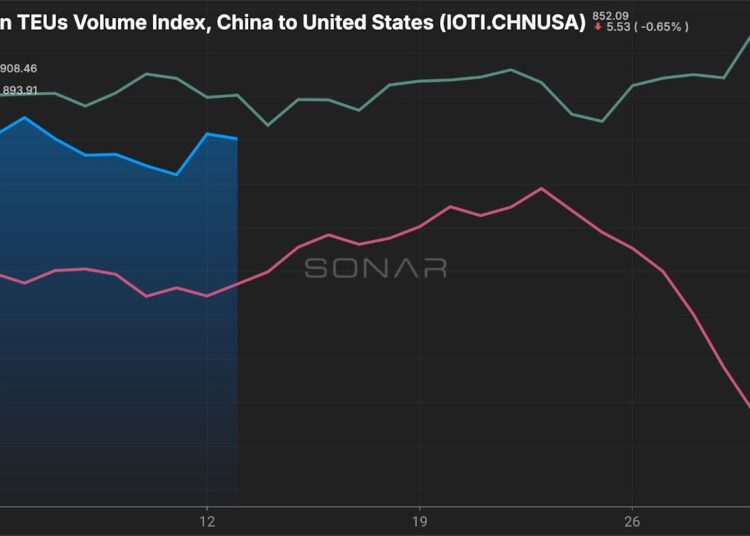

As of Monday, the SONAR Inbound Ocean TEUs Volume Index shows that import container bookings from China to the U.S. (IOTI.CHNUSA) are down 12% compared to the same period in 2024 but up 30% compared to 2023.

Source: FreightWaves SONAR, Inbound Ocean TEUs Volume Index. To learn more about FreightWaves SONAR, click here.

Trump has also indicated he wants to renegotiate the U.S.-Mexico-Canada Agreement (USMCA) in 2026.

“I don’t think USMCA needs to be redone. I think it’s been extremely beneficial. Texas has really taken advantage of the growth in trade. It has been beneficial to border communities, such as Laredo, Texas. This means jobs and economic growth for those communities. It has been a tremendous boon for Mexico and Texas trade,” Canavati said.

The post US-Mexico trade up in November as Trump’s tariffs loom appeared first on FreightWaves.