FreightWaves’ “State of Freight” webinar for May offered little optimism that demand for cargo capacity will return at any point this year.

Craig Fuller, FreightWaves CEO and founder, said he doesn’t see any signs of a significant uptick in demand for freight capacity in 2023.

Here are five takeaways from the webinar:

Spot rates not ‘out of the woods’ yet

May is usually the time of year when spot rates start to trend upward due to seasonal demand, FreightWaves market expert Zach Strickland said, but that seems unlikely now.

“We have this backdrop of where we’ve come out of this period of time where capacity has grown beyond any amount of demand that we could expect to happen this time of year seasonally speaking,” Strickland said. “In regards to rate pressure, have we seen anything start to kind of bubble up?”

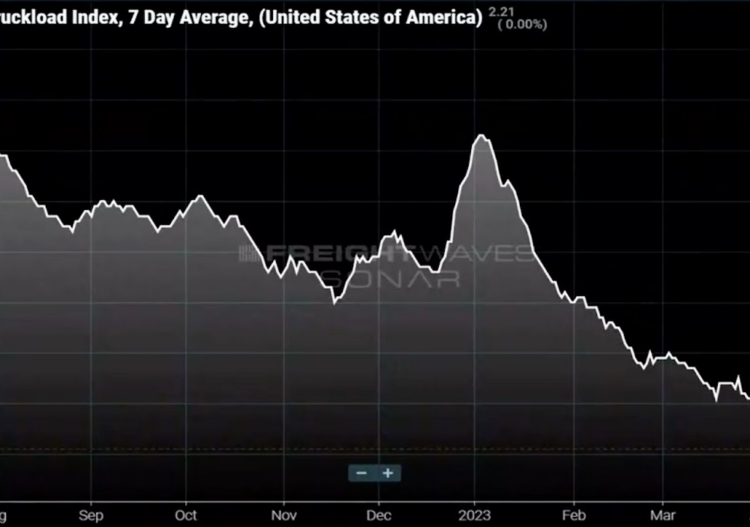

Fuller said although current data from FreightWaves’ National Truckload Index (NTI.USA) is showing some slight upward trends in the spot rate, he doesn’t expect spot rates to continue rising the rest of the year.

The National Truckload Index shows spot rates currently hovering around $2.21 per mile, while linehaul spot rates (NTIL.USA) are around $1.59 per mile.

“It’s Roadcheck week, which means a lot of those independent owner-operators decided that they didn’t want to deal with the headaches of being out on the road and having inspections and dealing with that,” Fuller said. “I think we will also probably see some upward pressure this week because it is a holiday week, a long weekend, the weather is good, and a lot of truck drivers will stay out for this week as well.”

Fuller said although rates may not get much lower this year, it doesn’t mean that trucking companies will bounce back anytime soon.

“The operating cost for trucking companies, taking fuel out of the equation, but looking at things like driver salaries, maintenance, equipment costs, operating costs for a fleet, has gone up as much as 30 cents a mile [since 2019],” Fuller said. “It may be that we’ve hit a bottom for rates; it doesn’t mean that we’re out of the woods.”

Consumers won’t rescue the freight market anytime soon

While some carrier executives have recently predicted that the second half of the year could be better than the first, Fuller disagreed.

Consumers are facing financial stresses from a lot of different directions, such as student debt, less discretionary funds and inflation, Fuller said.

“I think what we should worry about in the freight market is what is the story around the consumer, because they drive an enormous amount of our economy, and do we believe that the consumer is going to continue to spend the way they have spent? I just don’t buy it,” Fuller said.

One of the biggest burdens more than 25 million Americans will face is the end of student loan forbearance, possibly as early as September. Fuller recently wrote about it in an article titled “An unusually terrible freight market may get a lot worse.”

Student loan debt is in excess of $1 trillion, representing about 7% of U.S. GDP. The average student loan payment is $393 per month.

Many of the 25 million Americans who have deferred payments for student debt are ages 18-44, one of the most important demographic groups that drive consumer spending.

“I think what we have to be concerned about is that what drives the freight economy is good consumption,” Fuller said. “Goods are one of those things that if you think about discretionary spending, it’s the stuff that you pull back on. That’s the stuff that really matters in terms of freight demand. I just can’t make the case that there are any really bullish signs in the second half.”

Equipment sales could go lower in 2023

Both Fuller and Strickland said they don’t believe that equipment sales have found a floor, with truck orders possibly going lower the rest of the year.

“I don’t think equipment sales have bottomed out, I think a lot of the conditions in the market [lower demand for capacity] for some of the carriers is relatively new, particularly for the larger fleets, or fleets that had a lot of contracts,” Fuller said. “They really weren’t seeing significantly challenging conditions until now, February, March and April.”

Fuller said the larger carriers are what drive the trucking equipment market.

“Those are the companies that have bought the new equipment and are the ones that go to sell them in a three- to five-year time frame,” Fuller said. “I certainly would not go out and recommend anyone buy anything right now.”

Intermodal rates will rise when truckload rates recover

Fuller said when spot rates are as low as they are now, many shippers move their freight away from intermodal and take advantage of lower truckload prices.

“Once we see spot rates rise, that’s when you will start to see pressure on intermodal rates,” he said.

Fuller and Strickland also said intermodal rates depend on some of the biggest lanes in the country, such as from the Port of Los Angeles to Chicago.

“That lane is suffering not just because of the loss in demand, but the market share loss,” Strickland said. “Until those trends change, intermodal prices are going to stay, probably moving in alignment with the trucking sector.”

Federal Reserve unlikely to pause raising interest rates

Fuller said he doesn’t foresee any scenario in which the Federal Reserve will pause raising interest rates, which some economists believe could help spur consumer spending.

The Fed raises its key rate to increase the cost of mortgages, auto loans, credit card borrowing and business loans. By making borrowing more expensive, it seeks to slow growth and inflation. Federal Reserve officials have raised the benchmark rate to about 5.1%, a 16-year high.

“Some of the reports suggested that the Federal Reserve is still talking about fighting inflation, that they don’t see signs that inflation is going away,” Fuller said. “I think a lot of what is driving sort of a one-track mind inside the Federal Reserve are the employment numbers, in terms of driving inflation. I think because of that, I find it hard to believe that they are going to signal that they are going to loosen monetary conditions.”

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

US wants labor rights investigation of Goodyear plant in Mexico

Truckers threaten to boycott Florida over migrant crackdown

Canadian town wins another court battle against illegal trucking operation

The post ‘State of Freight’ for May: No signs of 2nd-half recovery appeared first on FreightWaves.