Less-than-truckload carrier Saia said it’s not too concerned with lumpy financial performances from quarter to quarter as it builds out a national network through terminal acquisitions. It’s more focused on the long-term capabilities of the business and the returns that can be generated now that it services all 48 contiguous states.

Saia (NASDAQ: SAIA) missed third-quarter expectations Friday, reporting earnings per share of $3.46. The result was 7 cents below the consensus estimate and 21 cents lower year over year.

“These investments were never about the current quarter, the next quarter or frankly next year, but an opportunity to transform our footprint and market positioning into the future,” said Fritz Holzgrefe, Saia’s president and CEO, on a Friday call with analysts.

The carrier opened 11 new terminals and relocated one facility during the third quarter. It has opened 18 new service centers so far this year and will add three more in the fourth quarter. The 21 new locations are part of an expansion program that has also included relocating some terminals into larger and better located spaces.

The company said it will close the year operating 214 service centers, noting that some of the new sites can be scaled up to take on more volume when the market turns.

It acquired 28 terminals from bankrupt Yellow Corp.’s (OTC: YELLQ) estate for $235.7 million earlier this year. Debt incurred from funding the purchases resulted in a nearly $5 million y/y swing from interest income to interest expense in the quarter, or a 14-cent y/y drag on EPS.

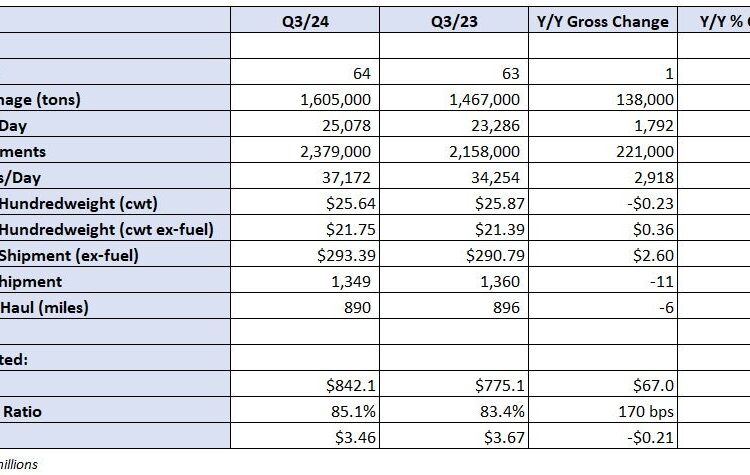

Table: Saia’s key performance indicators

Revenue increased 8.6% y/y (up 6.9% on a per-day basis) to $842 million in the third quarter. Tonnage per day was up 7.7% as an 8.5% increase in daily shipments was partially offset by an 0.8% decline in weight per shipment. Tonnage was up 14.4% on a two-year stacked comparison in the third quarter, largely due to the influx of freight Saia has won since Yellow’s shutdown last summer.

So far, October tonnage is up 6.5% y/y. A cyberattack at competitor Estes last year has made this year’s comp a little tougher. Also, the company’s Southeastern terminal footprint was disrupted by hurricanes.

Revenue per hundredweight, or yield, was down 0.9% y/y (up 1.7% excluding fuel surcharges). The y/y comps have gotten tougher now that a year has lapsed since Yellow closed. Changes in yield have also been dragged down by a shift in freight mix to retail shipments as well as more freight from national accounts, which are typically priced on thinner margins.

Management said contractual renewals were up more than 7% in the quarter and noted that it implemented a 7.9% general rate increase on Monday. The GRI is applied to general tariff codes and represents an expected average of changes to base rates across various lanes and weight classes.

Saia reported an 85.1% operating ratio (inverse of operating margin), which was 170 basis points worse y/y and 180 bps worse than the second quarter. The result was in line with management’s guidance of 100 to 200 bps of sequential deterioration.

Cost per shipment moved 0.6% higher y/y while revenue per shipment fell 1.6%.

Salaries, wages and benefits expense increased 280 bps as a percentage of revenue. An increase in head count and a 4.1% annual wage increase implemented in July were some of the headwinds. Purchased transportation expenses declined 210 bps.

In addition to the negative freight mix, costs associated with opening and relocating terminals weighed on the period. However, management said the terminals opened in the second quarter are now profitable. Given the positive momentum at the new locations, management expects to outperform the normal sequential OR deterioration of 250 bps from the third to the fourth quarter this year.

The company reiterated a $1 billion net capex plan for 2024. The initial plan called for allocations of $550 million on real estate, $400 million to $450 million for equipment and approximately $50 million on IT projects. It has spent $873.2 million on capital improvements so far this year.

Shares of SAIA were up 10.1% at 12:01 p.m. EDT on Friday compared to the S&P 500, which was up 0.5%.

More FreightWaves articles by Todd Maiden

Pam Transportation’s TL unit records fourth straight operating loss

Old Dominion points to October as ‘a sign of hope’

Saia to open 3 terminals in October, pushing 2024’s count to more than 20

The post Saia comfortable with near-term noise amid terminal expansion appeared first on FreightWaves.