Management from freight broker RXO said truck capacity is exiting the market but that it isn’t willing to speculate on when the next move in the cycle may occur.

The industry has seen carriers head for the exits, especially those heavily dependent on what remain depressed spot rates. CEO Drew Wilkerson said he’s seeing the same trends in RXO’s (NYSE: RXO) carrier network during an appearance Wednesday at a Wells Fargo (NYSE: WFC) investor conference in Chicago.

He said the load-to-truck ratio was 2 to 1 at the time of the first-quarter call in early May, a level rarely sustained during a downcycle, but noted the current ratio is closer to 3 to 1, implying some sequential tightening in the market.

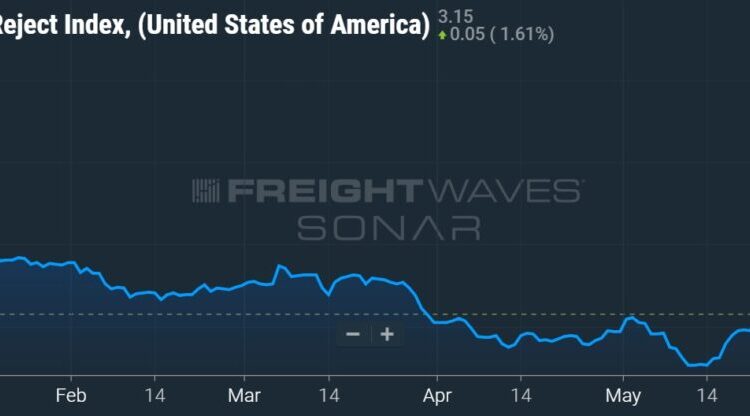

Tender rejections tracked by FreightWaves SONAR are bobbling along the bottom but have at least seen some volatility in recent weeks, potentially a sign that a new trend will form.

Chart: (SONAR: OTRI.USA). A proxy for truck capacity, the Outbound Tender Reject Index, shows the number of loads being rejected by carriers. The index has fallen to just 3%. To learn more about FreightWaves SONAR, click here.

Wilkerson said demand from customers in the technology, health care and auto sectors remains firm but retail and e-commerce volumes are still weak but improving. Retail-related volumes were off by a high-single-digit percentage in the fourth quarter but only by low- to mid-single digits in the first quarter.

“The conversation really shifted three or four months ago where it was less about destocking and it was more about restocking,” Wilkerson said. “Now … it’s going to come down to is the demand there so that they are able to fulfill the orders from the restocking.”

The mix in RXO’s brokerage business is 77% contract with 23% tied to the spot market. Contract rates have been down 10% to 15% across the industry and management said it will “lean heavily” into the spot market as a correction takes place, noting it has been able to shift its spot-contract mix by 1,000 basis points in the span of three months in the past.

Management did note there could be some sequential degradation in gross margin from the first to the second quarters.

“When the inflection happens it typically happens pretty fast,” Wilkerson said. He said when shippers are pushed into the spot market they usually go to a provider of choice first and that the company’s $3 billion brokerage platform provides it with ample data, which allows it to quickly alter pricing algorithms.

Chart: (SONAR: NTIL.USA). The National Truckload Index (linehaul only – NTIL) is based on an average of booked spot dry van loads from 250,000 lanes. The NTIL is a seven-day moving average of linehaul spot rates excluding fuel. Spot rates are currently 18% lower y/y.

Wilkerson said the brokerage unit grew volumes by 20% to 30% during the last market inflection (2020-2021) while maintaining industry-leading margins.

RXO reported a 6% year-over-year increase in brokerage loads during the first quarter and kept its gross margin flat at 16.3%. The company grew volume by 13% at its top 20 customers in the period even though the group’s overall volumes were down collectively.

While the freight market is in a static state, RXO remains committed to its longer-term financial targets. In addition to capturing market share, management reiterated a goal of $475 million to $525 million in adjusted earnings before interest, taxes, depreciation and amortization by 2027, a 60% increase from the end of 2022.

The company generated a 42% return on invested capital last year and expects to convert 40% to 60% of EBITDA into free cash flow. Those funds will be used to repurchase shares and pursue acquisitions.

The 2027 EBITDA goal does not include any contributions from future M&A.

More FreightWaves articles by Todd Maiden

J.B. Hunt still waiting for market recovery

Freight shipments, spend see largest y/y declines in nearly 3 years

Teamsters not ‘bailing out’ Yellow again, unmoved by carrier’s finances

New data does not mean old problems are gone

The post RXO continues to perform as cycle inflection lingers appeared first on FreightWaves.