Knight-Swift Transportation significantly lowered its 2023 full-year outlook Thursday, citing the expectation for further weakness in truckload and intermodal rates, lower gains on equipment sales, and losses at recently acquired U.S. Xpress.

The company is now calling for full-year earnings per share of $2.10 to $2.30, well below the prior guide of $3.45 (at the midpoint of the range) and its initial outlook of $4.15 (at the midpoint). Further, the new outlook is only slightly greater than half of the $4 EPS mark that management and analysts had previously pointed to as a likely floor during cycle troughs.

The consensus estimate at the time of the Thursday print was $2.76, according to Yahoo Finance.

Revenue per mile in Knight-Swift’s (NYSE: KNX) truckload segment is now expected to decline between high-single and low-double-digit percentages this year. The carrier was previously expecting only a high-single-digit decline.

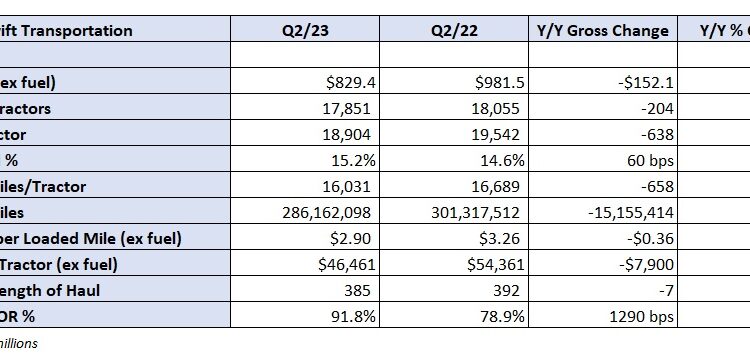

Revenue per loaded mile excluding fuel surcharges was down 11% year over year (y/y) in the second quarter. Loaded miles per tractor fell 4%. The combination led to a 15% y/y decline in revenue per tractor.

Cost inflation and lower equipment utilization weighed on the division’s operating ratio. A 91.8% OR was nearly 1,300 basis points worse y/y. Management said the period represented the lowest utilization rate for any second quarter in the company’s history, citing soft demand and a tight labor market as the detractors. However, it said the metric bottomed in April and improved through the remainder of the quarter.

Lower gains on sale were a culprit as well. Guidance for gains on the sale of equipment was lowered by $5 million on each end of the new range of $10 million to $15 million per quarter.

Table: Knight-Swift’s key performance indicators – TL

Management also called out weakness in the intermodal unit as a reason for the guidance reduction. Intermodal loads were 4% higher y/y in the quarter, but revenue per load fell 25% y/y (15% lower sequentially). The unit posted a 106.4% OR, booking a $6.6 million operating loss.

The outlook calls for breakeven results in intermodal during 2023, with volumes improving y/y but rates being further pressured.

Table: Knight-Swift’s key performance indicators – Logistics and Intermodal

Other headwinds caused management to reel in guidance.

It said the U.S. Xpress operations, which were not included in prior guidance, will be a 25-cent to 30-cent drag in the back half of the year. Higher interest rates are roughly a 35-cent headwind y/y, and a loss in its third-party insurance business, versus the prior outlook for a profit, is a 45-cent hit to the original outlook.

The U.S. Xpress acquisition is expected to be accretive in 2024, with the unit seeing breakeven operating results in the first half of the year. The longer-term goal of $1 in adjusted EPS by 2026 was reiterated.

“If past cycles are any indication, the longer the time spent at the bottom, the more pronounced the rebound can be,” President and CEO Dave Jackson said. “As such, while we diligently control costs and mitigate risk in the current environment, we are positioning our business for the eventual recovery.”

The company is seeing some uptick in demand in its less-than-truckload segment, in part due to the troubles at carrier Yellow Corp. (NASDAQ: YELL). Management said it has the capacity to absorb up to double-digit increases in volumes and will look to be “opportunistic” in acquiring terminals that become available on the market, similar to what it did when Central Freight Lines shut down.

“We stand ready to help and serve our customers, especially if they are dealing with some uncertainty along the way,” Jackson said.

Shipments per day in LTL were down 4% y/y in the quarter and weight per shipment was off 1%. However, revenue per hundredweight excluding fuel increased 7%. The unit booked an 85.1% OR, which was 640 bps worse y/y.

Table: Knight-Swift’s key performance indicators – LTL

Consolidated second-quarter earnings per share of 49 cents were more than 90 cents lower y/y and 8 cents light of consensus.

Headwinds included higher interest expense (5 cents), a loss in its third-party insurance business due to unfavorable claims development (7 cents) and lower gains on sale (4 cents), among other items. However, the carrier didn’t have to contend with the 16-cent hit it took a year ago due to valuation changes in its equity stake in Embark Trucks. That position was liquidated when the company was taken private in May.

Table: Knight-Swift’s key performance indicators – Consolidated

Management expects the loss in its insurance business to be roughly $10 million in the back half of 2023 compared to $38 million in the first half. It is “temporarily reducing exposure to third party insurance risk in an unusually difficult environment for small operators,” and will work to raise premiums on its book of business.

“We’re confident that our margins will return very quickly when the market improves,” said CFO Adam Miller.

More FreightWaves articles by Todd Maiden

Pam Transportation sees earnings fall 60% in Q2

Yellow blames Teamsters for liquidity crunch, union barks back

The post Knight-Swift reels in 2023 outlook after poor Q2 appeared first on FreightWaves.