J.B. Hunt Transport Services moved a record number of intermodal loads during the third quarter, but service issues and cost headwinds have constrained margins. After two years of declining yields, the company could be nearing an inflection on the pricing front.

Management from the company told investors Tuesday at Stephens annual investment conference in Nashville, Tennessee, that rail service in its Eastern network is excellent. However, it continues to see hiccups on transcontinental lanes given a surge in imports to the West Coast. Some shippers pulled shipments forward this year to avoid the possibility of a prolonged strike at the East and Gulf Coast ports. While there was only a brief labor disruption to start October, a permanent resolution has yet to be reached.

During the third quarter, J.B. Hunt’s (NASDAQ: JBHT) transcontinental loads were up 7% year over year and by a double-digit percentage on eastbound lanes out of Southern California. J.B. Hunt’s rail partner in the West, BNSF (NYSE: BRK.B), saw a 19% y/y increase in intermodal container moves during the third quarter and is still seeing midteens increases so far in the fourth quarter.

Container imports at the West Coast’s largest ports peaked in August at almost 1.2 million twenty-foot equivalent units, a more than 25% y/y increase.

By comparison, J.B. Hunt’s Eastern network saw just a 3% y/y increase in loads during the third quarter. In addition to the freight diversions, shorter lengths of haul to destinations in the East make the truckload market, where rates remain relatively depressed, a much more viable alternative.

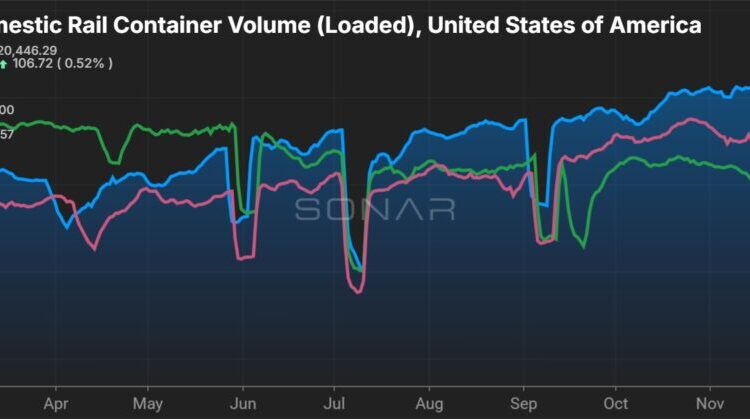

Chart: (ORAILDOML.USA). The daily volume of intermodal containers moving in the United States, Canada and Mexico. The index is a 7-day moving average using the date that containers were in-gated at point of origin. Intermodal trailers (trailer-on-flatcar, or TOFC) are excluded. To learn more about SONAR, click here.

Rate increases needed to address cost inflation

Darren Field, J.B. Hunt’s intermodal president, said “costs are creeping in” as the company has been shielding customers from the service issues in the West. He said it has been absorbing incremental costs associated with staging loads at off-site yards to prove the service sustainability of intermodal to customers while BNSF catches up to the volume influx.

Field said the problems are not structural in nature and once the railroad gets its head count right, service should improve. He believes that will happen in a couple of months.

BNSF’s total head count was flat sequentially in October, but transportation (train and engine) staff increased 0.4%.

He did caution that current container utilization rates (about 1.7 container turns per month) is likely the new norm and that the industry may not return to pre-pandemic levels of two box turns per month.

J.B. Hunt has also incurred equipment repositioning costs due to the network imbalance and is contending with a multiyear growth-related capacity investment that will push its container fleet 40% higher to 150,000 units.

Earlier this year, it acquired intermodal equipment from Walmart (NYSE: WMT), a longtime customer of the company. The deal, which included volume commitments, is now part of J.B. Hunt’s 40% growth plan.

J.B Hunt also hired 800 intermodal drivers from mid-June through September to accommodate the volume increase.

The company posted a 92.8% operating ratio (inverse of operating margin) in the third quarter, which was only 10-basis-point improvement from the cycle-worst OR posted during the second quarter. While margins have remained under pressure during the freight recession J.B. Hunt is hopeful pricing pressures will ease during the new bid season (started in October) after two years of declines in revenue per load. (Yields peaked in the third quarter of 2022.)

“That gives us a platform moving into ’25 to really talk about challenges we in our industry have faced, and we would anticipate that as we move into next year we would certainly like, and at this point expect, to see prices inflect positive,” Field said.

Chart: (SONAR: IMCRPM1.USA). The average initial per-mile base rate (no fuel or accessorial charges) of mostly contracted freight volumes reported on a 14-day lag.

Field didn’t say how much rates could increase but noted that one bid cycle likely won’t be enough to push margins back within the longer-term target range of 10% to 12%. On the company’s third-quarter call in October, he said J.B. Hunt will likely be living with the lower yields through the first half of 2025, given the timing of contract renewals.

He does expect the new bid cycle to be healthy enough to keep the Eastern network in growth mode. As TL rates move higher, more freight will convert from over-the-road to intermodal.

On a consolidated basis, the company was carrying $100 million in additional operating costs earlier in the year. The bulk of the costs (depreciation and storage fees on equipment) are tied to carrying excess capacity – intermodal containers and trailers in its truckload unit – ahead of an eventual recovery. The company hasn’t updated that number, but it has likely moved lower as demand has ticked up and it has been rightsizing office staff through attrition.

More FreightWaves articles by Todd Maiden

Freight shipments, spend see no lift in October, Cass data shows

LTL general rate increases buck pricing concerns for industry

Yellow shareholder loses bid to quash pension claims

The post J.B. Hunt eyes intermodal pricing inflection appeared first on FreightWaves.