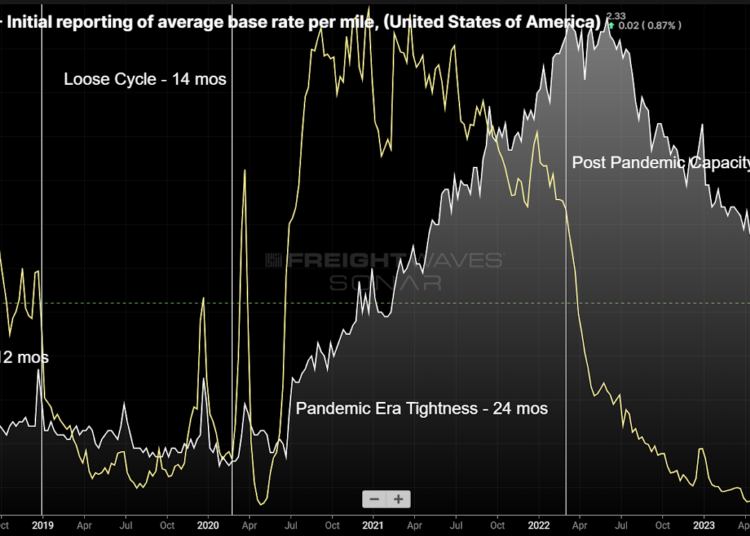

Chart of the Week: Van Contract initial report of average base cost per mile, Van Outbound Tender Rejection Index – USA SONAR: VCRPM1.USA, VOTRI.USA

The post-pandemic trend of pricing long-term or contract rates to the floor is not over, but the data shows this is slowly ending.

Looking at the past six years of dry van contract rates (VCRPM1) and van tender rejection rates (VOTRI), we can see a lagging correlation between the two. Rejection rates tend to lead the slower-to-move contract rates.

What’s a tender rejection rate?

Tender rejections are a measure of carrier compliance or adherence to covering freight under a previously agreed-upon price. Load tenders are electronic requests sent from a shipper to a transportation service provider asking if it can cover a truckload move. The service provider accepts or rejects the load.

The tender rejection rate is the percentage of tenders the transportation provider declines to cover. The higher the number, the tighter the market. Historically, national figures below 5% have indicated that contract rates will fall as there is more carrier capacity than demand for freight. When the OTRI is above 7%-8%, rates tend to increase.

It should be noted that FreightWaves SONAR’s tender and contract rate data biases toward large shipper-to-carrier contract agreements, which represent the baseline and majority of the freight market.

Which era is trucking in?

There have been four general cycles of the transportation market over the past six years, when the tender data history started in 2018. That cycle began in 2017, but we only have history for the past 12 months. This market was characterized by rejection rates averaging above 17% and a strong single upward trend in contract prices that stabilized.

The 2019 market was characterized by a rebalancing of capacity after an overheated capacity growth period in 2018. The above chart shows net changes in active motor carrier of property operating authorities registered to the Federal Motor Carrier Safety Administration. It is not a pure measure of capacity since an authority can represent any number of trucks. It also biases toward growth. Periods of deterioration (in red) are not as common as growth (green).

Rejection rates averaged just below 5% from February to December in 2019, with the market bottoming in August at 3.2%. This cycle lasted 14 months before COVID hit the U.S. in March 2020. There were signs that capacity was tightening before the black swan pandemic event hit, however. Holiday season rejection rates spiked above 14% that year.

The pandemic era was characterized by overwhelming demand and lasted roughly two years, with rejection rates averaging above 20% and rates increasing 50%. The capacity growth was subsequently historic as operators flooded the market, many leaving larger fleets to start their own ventures.

Unfortunately that growth proved to be an unsustainable bubble and began bursting in 2022. Contract rates fell rapidly from July 2022 to the spring of 2023 but have slowed since.

Rejection rates bottomed in May of last year around 2.5% and have been slowly trending higher since. While tender rejections are still hovering in deflationary territory, the indication is that they could move above the 5% threshold sustainably sometime in the next year.

What to do?

For carriers it is a game of survival. For shippers it is an exercise in risk management. For brokers/3PLs it is a balance of both. Shippers have the least sense of urgency but the most control. As with all freight markets, success is determined by how much preparation was made in the previous cycle. The controlling party has to prepare before its turn ends.

Shippers can do the most to control their destiny at this point. Maintaining service should be the goal for any bids implemented moving forward. Some lanes will be harder to cover in a tight market. Diversified route guides and not having rock-bottom rates compared to the market will be crucial.

Service providers need to be vigilant. Watching the market closely for signs of disruption is the easiest action but sometimes hard to do if only looking internally. Targeting customers who are willing to take the above approach is easier said than done, but it is certainly more attainable than in the pre-COVID world.

The timing of a cycle turning has been impossible to predict with precision, but there have been signals that it is approaching. Let’s end this one with a timeless quote from Louis Pasteur, which has become somewhat cliche: “Fortune favors the prepared mind.”

About the Chart of the Week

The FreightWaves Chart of the Week is a chart selection from SONAR that provides an interesting data point to describe the state of the freight markets. A chart is chosen from thousands of potential charts on SONAR to help participants visualize the freight market in real time. Each week a Market Expert will post a chart, along with commentary, live on the front page. After that, the Chart of the Week will be archived on FreightWaves.com for future reference.

SONAR aggregates data from hundreds of sources, presenting the data in charts and maps and providing commentary on what freight market experts want to know about the industry in real time.

The FreightWaves data science and product teams are releasing new datasets each week and enhancing the client experience.

To request a SONAR demo, click here.

The post Is the rate rollercoaster about to turn appeared first on FreightWaves.