Asset-light trucking company Forward Air announced Tuesday that tonnage was down 8% year over year (y/y) for the first two months of the second quarter.

Forward (NASDAQ: FWRD) noted the severity of the y/y declines has eased as the second quarter has progressed. Tonnage in its expedited segment, which includes less-than-truckload, truckload and final mile, was down 9.4% y/y in April and 6.4% in May. Continued improvement was also seen in the first couple of days in June.

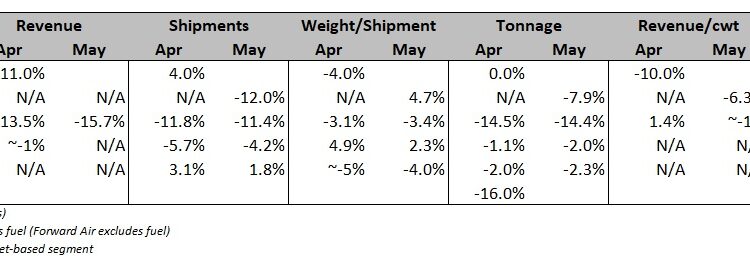

The quarter-to-date tonnage decline was the combination of a 12% y/y drop in shipments, which was partially offset by a 4.7% increase in weight per shipment. Higher shipment weights were driven by a 10.2% increase in weight per piece. The heavier weights were a drag on revenue per hundredweight, or yield, which was 6.3% lower y/y excluding fuel surcharges.

Table: Company reports

Given the work the company has done to attract heavier, higher-value freight to the network, and the negative impact it has on yield calculations, management has begun to disclose revenue per ton mile, which was 2.1% higher y/y in the period. Management said the metric during the two-month period was the highest it has ever been.

However, it was quick to caution that diminishing declines throughout the quarter may not be indicative of an inflection point.

“Even with some early signs of an improving freight environment, we believe the softer demand will continue to be a headwind through the reminder of the second quarter,” Chairman, President and CEO Tom Schmitt stated.

If the current minus-8% trend holds through June, Forward’s tonnage will still increase 7% sequentially in the second quarter, suggesting that the worst of the volume degradation may be in the rearview mirror.

By comparison, Forward’s tonnage was down 12% y/y in the first quarter, with revenue per ton mile (excluding fuel) up between 2.5% and 4%.

Forward’s quarter-to-date tonnage declines were more pronounced than LTL carriers Saia (NASDAQ: SAIA) and XPO (NYSE: XPO), which reported roughly 2% declines, but better than the near-15% drop logged by Old Dominion (NASDAQ: ODFL) in the period.

The release didn’t comment on Forward’s second-quarter guidance, which calls for a y/y revenue decline between 7% and 17% and earnings per share of $1.28 to $1.32.

Shares of FWRD were up 2.8% on Tuesday compared to the S&P 500, which was up 0.2%.

More FreightWaves articles by Todd Maiden

Yellow, Teamsters point fingers; parties still far apart on deal

XPO’s tonnage dips again in May, inflects higher from Q1

Transportation prices fall at fastest-ever pace in May

Louisville, Green Bay markets highly resisted by carriers

The post Forward Air’s tonnage declines cool as Q2 advances appeared first on FreightWaves.