Higher combined revenues for the second quarter of 2023 helped boost net profits for Canadian Pacific Kansas City.

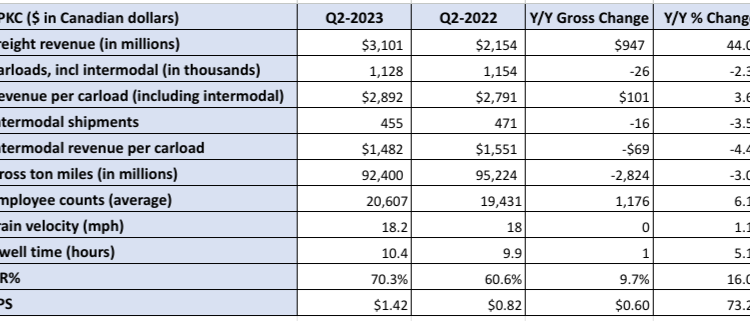

Revenues for the second quarter were nearly CA$3.2 billion (US$2.4 billion), up 44% year over year (y/y), CPKC said Thursday afternoon. The y/y figure reflects CP’s results in the second quarter of 2022. Canadian Pacific and Kansas City Southern completed their merger in April to become CPKC (NYSE: CP). Results are reported in Canadian dollars.

Net income was $1.3 billion, or $1.42 per diluted share, for the second quarter of 2023, compared with $765 million, or 82 cents per diluted share, for the second quarter of 2022.

Expenses were $2.2 billion, compared with $1.3 billion y/y.

Meanwhile, volumes fell 3% to 1.1 million carloads amid lower volumes for potash, fertilizer and sulfur, and forest products. Volumes for intermodal and energy, chemicals and plastics were also lower y/y.

“Despite the challenging results, we still expect to deliver mid-single-digit core adjusted combined diluted EPS growth in 2023,” CPKC President and CEO Keith Creel said in a news release. “The long-term growth opportunities for this franchise are unique and undeniable. With our CPKC advantage, we are extending our reach for our customers, introducing new service offerings to the marketplace and creating new competition in North American supply chains.”

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Related links:

Canada’s dockworkers strike impacts freight rail operations

CPKC, CSX form joint venture for hydrogen locomotives

CPKC and Americold collaborate on refrigerated rail service offerings

The post CPKC’s Q2 net income rises above $1B appeared first on FreightWaves.