Early numbers on the first quarter are starting to trickle in from container shipping lines. They show a big step down from the fourth quarter, but they also confirm that earnings are still well above the pre-COVID “normal.”

Spot rates in the trans-Pacific eastbound market have collapsed, yet carriers continue to be shielded by annual contracts signed in 2022. Meanwhile, spot rates in the trans-Atlantic westbound market remain much higher than they were prior to the pandemic.

Average revenue per forty-foot equivalent unit — the big driver of container shipping net income — remains higher than it was before 2020.

OOCL revenue per FEU 40% higher than pre-COVID

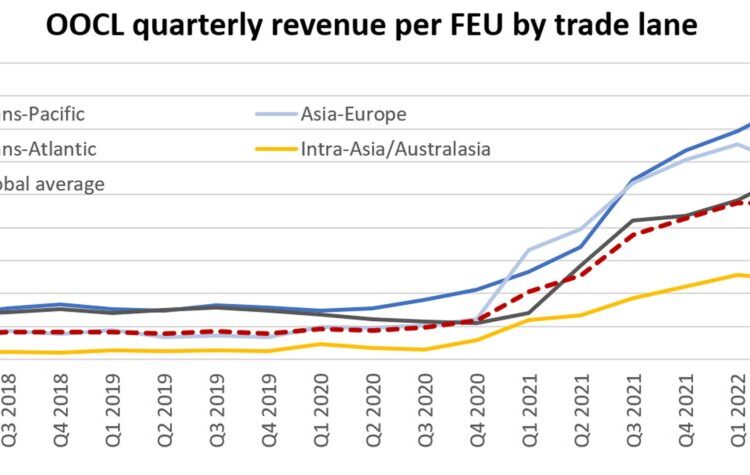

Hong Kong-based OOCL, a subsidiary of China’s Cosco, earned a global average of $2,503 in revenue per FEU in Q1 2023.

That’s down 56% year on year (y/y) and 31% sequentially versus Q4 2022. However, OOCL averaged $1,793 in revenue per FEU in the eight quarters during 2018 and 2019, prior to the pandemic-induced shipping boom. Its Q1 2023 revenue per FEU was 40% above that average.

(Chart: FreightWaves based on data from OOCL securities filings)

OOCL achieved $2,914 in revenue per FEU in the trans-Pacific lane in Q1 2023, down 63% y/y and 41% quarter on quarter (q/q) but still up 16% versus pre-COVID.

OOCL’s Asia-Europe trade averaged $2,524 per FEU, down 66% y/y and 39% q/q but 42% above the 2018-2019 average.

The carrier’s smallest market by volume — the trans-Atlantic — was its best performer. Q1 2023 trans-Atlantic revenue came in at $4,865 per FEU, 99% higher than pre-pandemic levels. Trans-Atlantic revenue per FEU was down 17% y/y and 23% q/q.

The intra-Asia trade is by far OOCL’s largest market by volume. In general, rates in this trade are lower than in the mainline east-west markets. OOCL posted revenue of $1,867 per FEU in Q1 2023 in the intra-Asia trade, down 48% y/y and 22% q/q but still up 51% from the 2018-2019 average.

Evergreen operating revenue up in March vs. February

Taiwan’s Evergreen, the world’s sixth-largest ocean carrier, reports monthly operating revenues. It disclosed its March revenues on Monday.

Evergreen’s operating revenues totaled 66.8 billion New Taiwan dollars ($2.2 billion) in Q1 2023. That’s down 61% y/y and 40% q/q, but still up 46% from Q1 2019, pre-COVID.

(Chart: FreightWaves based on Evergreen securities filings)

Looking at the monthly trend, OOCL reported operating revenues of 21.9 billion New Taiwan dollars in March.

This was up 17% from February, marking the first m/m increase since last July.

(Chart: FreightWaves based on Evergreen securities filings)

Freight rates fall at much slower pace

Indexes covering spot freight rates and long-term rates show continued deterioration, but at a much slower rate of decline than in the second half of 2022. Xeneta’s XSI Global index, which tracks long-term contract rates, fell just 0.5% in March versus February, to 345.87 points, “a slower pace than in previous months,” said Xeneta.

The XSI is down 24% from its all-time high in August 2022, however, it’s still up 30.5% y/y and is around three times pre-COVID index levels.

The Drewry World Container Index global composite — which measures average spot rates — was unchanged w/w for the week ending Thursday, at $1,710 per FEU.

The WCI global composite is down 79% y/y and is 84% below the all-time high of $10,277 per FEU reached in September 2022. Yet the index is still 20% above its 2018-2019 average, said Drewry.

Weekly spot rate assessment in USD per FEU. (Chart: FreightWaves SONAR)

Click for more articles by Greg Miller

Related articles:

Mixed signals: Container shipping downturn not following the script

Mighty fall: Container line profits plummet from historic peak

LA-LB outlook darkens as labor unrest briefly shutters ports

Crunch time for trans-Pacific container shipping contract talks

Imports sink again as wholesale inventories remain bloated

‘Colossal’ tidal wave of new container ships about to strike

The post Container lines still up vs. pre-COVID despite fall from peak appeared first on FreightWaves.