U.S. box demand has been consistently worse than the largest box makers expected over the past three quarters — with recent declines among the steepest since the Great Financial Crisis — and recent signs point to more of the same weakness.

The largest U.S. boxboard/folding carton producer, Graphic Packaging, presented at a conference Tuesday at which its CFO Steve Scherger said the company is experiencing destocking among retailers following “awkwardly high” demand a year ago. Following those comments, its shares fell.

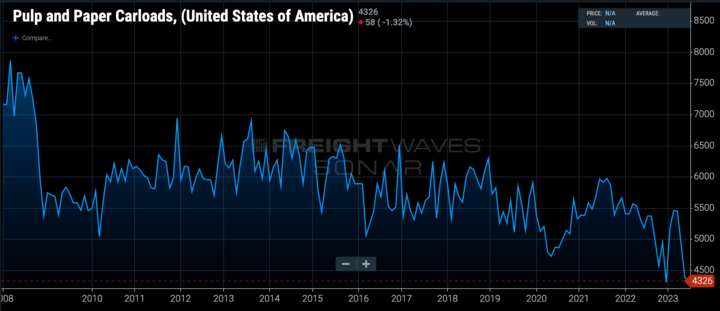

Folding cartons frequently get shipped in boxes. And recent weekly U.S. pulp and paper carloads data has been historically weak (more below on this topic), another possible sign of weakness in box demand and a definite sign of weakness in pulp and paper demand more broadly.

FreightWaves has written extensively in recent months about the historic weakness in U.S. box demand, which is among the best leading indicators for the economy.

Box demand hit record highs during the pandemic, not surprisingly given unprecedented U.S. government stimulus spending coupled with a dramatic shift from spending on services to spending on goods (box demand is tied to goods demand).

However, as Americans’ real average weekly income has consistently fallen for the past two years (the May data came out Tuesday morning, in fact), they’ve spent the money the government handed out to them and are now having to take on record levels of credit card debt (at 25% interest rates no less). Consequently, goods demand has dried up, specifically purchases of big-ticket discretionary items such as furniture, appliances, etc.; that trend was evident in a wide swath of retail earnings reports in Q1.

The rate of box shipment declines accelerated throughout Q1, with March down an eye-opening 11%. The three largest producers reported Q1 declines ranging from 8-13%.

There’s no real-time data on box volumes as there is on freight volumes. The closest thing to a real-time box demand indicator available is the weekly Association of American Railroads (AAR) pulp and paper products carloads data. Pulp and paper products is a subset of the Forest Products category that AAR reports that includes packaging/boxes. As shown in the chart below, weekly rail carloads have gotten progressively worse in recent weeks, and year-to-date average carloads are at historically low levels.

(Chart: FreightWaves SONAR.)

One common question is whether other types of packaging, specifically lighter-weight paper and plastic mailers, are replacing cardboard boxes. Indeed, large retailers are making a concerted effort to reduce the number of boxes they’re using, a problem the corrugated industry will have to contend with in addition to the profoundly weak goods economy.

However, retailers such as Walmart also plan to replace nearly all plastic mailers with paper mailers, so it’s not as if plastic mailers are gaining share. To that end, FreightWaves recently reported that Sealed Air, a large producer of plastic and paper mailers, has been experiencing historically large volume declines.

The post Box demand likely remains under significant pressure as real wages continue falling appeared first on FreightWaves.