Transportation and logistics provider ArcBest is relying more on transactional freight to keep its network full as demand has cooled. The company recorded shipment growth in both its asset-based and asset-light segments during the first quarter, a stark contrast to reports from its competitors. However, the strategy comes with lower yields, which had some analysts concerned on a Friday call.

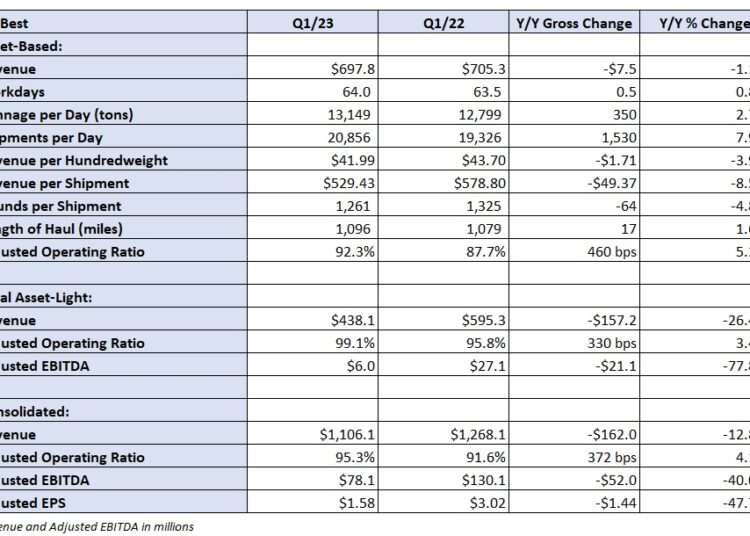

ArcBest (NASDAQ: ARCB) reported first-quarter adjusted earnings per share of $1.58 Friday before the market opened, short of the $1.67 consensus estimate and $3.02 a year ago. The consensus estimate was adjusted to exclude an outlier estimate of $3.58.

The adjusted EPS result excluded 83 cents in one-off items, including costs from a technology pilot, a fair value change in the MoLo deal earnout and other acquisition-related costs. The adjusted results also exclude the February sale of FleetNet America.

Is LTL pricing a concern?

Revenue in the asset-based unit, which includes less-than-truckload operations, declined 1% year over year (y/y) to $698 million as tonnage increased 3% and revenue per hundredweight, or yield, fell 4%. By comparison, competitor Old Dominion Freight Line (NASDAQ: ODFL) reported a 12% y/y drop in tonnage during the first quarter but yields were up 9%.

ArcBest is leaning on a dynamic pricing model to better match available network capacity to transactional shipments available in the market. The approach has helped prop up volumes as shipment counts and sizes have receded at core accounts, but it comes with a lower yield profile.

Hauling thinner-margin freight keeps capacity utilized, but it also keeps operating costs elevated. There is a high degree of fixed costs in an LTL carrier’s network. ArcBest could try to better align head count to the lower volumes at its higher-margin core accounts, but it wants the network appropriately staffed for an eventual uptick.

Head count in the unit is still lower than what it was heading into the pandemic.

ArcBest’s overall asset-based yield metric (down 4% y/y) faced a tough comparison — up 21% y/y in the 2022 first quarter. Also, heavier TL shipments dragged down the per-pound rate calculation.

Yields on LTL freight were down by a low-single-digit percentage excluding fuel surcharges. However, the company saw nearly a 10% yield increase on core LTL business (excluding fuel). Yields on core accounts were also up by low single digits sequentially from the fourth quarter.

Table: ArcBest’s key performance indicators

On whether the company is taking on volume at the expense of yield: “I don’t think we’ve pushed it too far,” said Danny Loe, chief yield officer. “We’re not going to add capacity for this business but capacity that we have and costs that we have, we want revenue to go against that. … These are incrementally profitable shipments that add to the profitably of the company in the short run.”

Contract renewals and deferred pricing agreements saw an average increase of 3.9% y/y, which concerned another analyst who questioned if that level of increase was high enough to cover future cost inflation given ongoing labor negotiations with the Teamsters.

“I think that remains to be seen,” said Judy McReynolds, chairman, president and CEO. “We have navigated through these different circumstances, environments and situations, and pricing is a strength of ours. … I’m confident in our ability to really navigate this to a good end.”

She said the average contractual rate increases are usually smallest in the first quarter and that the company has a variety of cost reduction initiatives in place. The goal is to continue to implement LTL pricing above cost inflation.

ArcBest is currently working though the supplements of its Teamsters labor contract, which expires at the end of June. The two parties have also begun talks around wages and benefits, which will likely increase as the union has been vocal recently, saying it will “fight like hell at the table to get the very best contracts” for its members.

Compared to 2022, per-day tonnage increased 1.6% in January, 2.1% in February and 4.3% in March, with shipments up by mid- to high-single percentages. Tonnage has been flat y/y in April. Yields are down 10% y/y in the month, which also has a tough comp (up 19% y/y in April 2022). Lower fuel surcharge revenue is also dragging the metric down.

Yields on core LTL accounts were up y/y by mid-single digits in April.

The weaker trends resulted in a 92.3% adjusted operating ratio in the first quarter, 460 basis points worse y/y, but sequential deterioration of 370 bps was in line with normal seasonality. As a percentage of revenue, salaries, wages and benefits (up 370 bps) and fuel (up 150 bps) were the biggest headwinds.

Lower gains on sale in the period were a 40-bp headwind to OR.

Management said it is taking actions to reduce cartage, purchased transportation and other third-party expenses. Purchased transportation as a percentage of revenue was down 160 bps in the period. Management’s guidance calls for 200 bps of sequential OR improvement in the second quarter.

Head count reductions in store at asset-light unit

ArcBest will reduce head count in its asset-light segment, which includes brokerage, as results decline further.

Revenue in the unit declined 26% y/y during the quarter to $438 million. Shipments per day were up 1% but revenue per shipment declined 31%. Similar percentage declines have been seen in April.

The business recorded a 99.1% OR, which was 330 bps worse y/y.

The company expects cost reductions of $2 million to $3 million in the second quarter. It previously terminated a pair of broker MoLo’s leaders in March.

More FreightWaves articles by Todd Maiden

Schneider pushes out freight recovery timetable, lowers guidance

Landstar sees April step down but says bottom is near

Old Dominion’s Q1 miss sends LTL stocks lower

Freight volumes have pushed back up to over 10,700 index points

The post ArcBest defends dynamic pricing strategy appeared first on FreightWaves.