Unlike manufacturers’ cautious optimism, economic anxiety is on the rise among consumers for the first time in six months.

The University of Michigan’s consumer sentiment index fell to 71.1 in January, below both analysts’ expectations of 73.2 and the previous month’s reading of 74.

There’s no cost like home

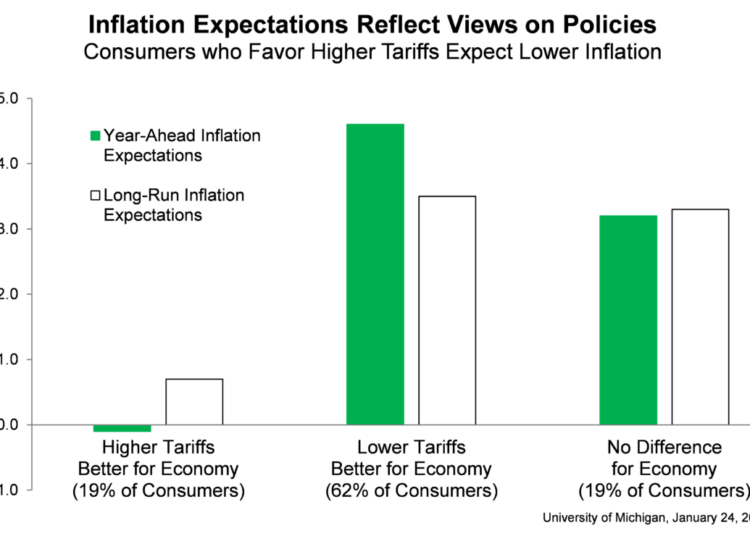

January’s decline is largely attributable to concerns about the return of inflation — specifically, beliefs about the potential threat of tariff-induced price increases.

Such concerns are critically important as consumer sentiment governs consumer spending, which is responsible for three-quarters of the U.S. economy. This growing pessimism could trigger a pullback in discretionary purchases, directly weighing on trucking demand.

The housing market is similarly in no great shape: In 2024, sales of existing homes were at their lowest since 1995.

Sluggish activity in the real estate sector is hardly surprising, however, given that would-be homebuyers face the one-two punch of persistently elevated mortgage rates and rising housing prices. Median home prices surged to a record $407,500 in December, which also saw a 2.2% uptick in sales during the month.

Meanwhile, the average rate on a 30-year fixed mortgage continues to hover around 7%. Rates shot up in late 2022 following a series of aggressive interest-rate hikes from the Federal Reserve. At the time, mortgage rates were rising to a two-decade high.

But, for the better part of the past two years, rates have remained more or less stable at 7% — a sharp contrast to the sub-3% mortgages of 2020-21.

Unfortunately for buyers, the Fed is unlikely to alter rates at next week’s meeting and could defer its next cut until March or even May. The labor market, though cooling, is steady enough to placate the Fed. Inflation thus top-of-mind for Fed officials for the next few months, unless a tidal wave of layoffs and/or bankruptcies prompts them to resume cutting.

Irons in the fire

That interest rates are not falling any time soon is also a headache for the industrial sector. Manufacturers often require loans for their large capital investments, such as equipment or materials. In a high-rate environment, such firms will be persuaded to hold off, if possible, on any major investments until loans can be had at a better rate.

The S&P Global Flash (i.e., preliminary) US Manufacturing PMI saw a slight bump out of contraction to 50.1 in January. This reading, which is barely above the no-change line of 50, indicates the start of a very fragile recovery after months of stagnation.

Despite this gain, the US Services PMI tumbled from December’s 56.8 to 52.8, a fall that dragged the composite index to a nine-month low. Both sectors reported an intensification of inflationary pressures, driven by input costs that are rising at their fastest pace in four months.

Even so, both sectors — but especially manufacturers — were hugely bullish on their future growth prospects. After seeing its largest monthly gain since November 2020, manufacturers’ confidence for the next 12 months swelled to its highest since March 2022.

“Uncertainty in the lead up to the Presidential Election has been replaced with optimism about the future,” wrote Chris Williamson, chief business economist at S&P Global. “Looser regulation, lower taxes and heightened protectionism were all widely cited [by survey respondents], alongside a broader sense of improving economic conditions in the year ahead under the new administration.”

Nor was this optimism merely lip-service, as employment in January spiked at its fastest pace in two-and-a-half years. This rally was led by the service sector, though manufacturing did see its highest growth in six months.

Reflecting on how this data might influence interest-rate policy going forward, Williamson concluded: “Higher input cost and selling price inflation was broad-based across goods and services and, if sustained, could add to worries that a combination of robust economic growth, a strong job market, and higher inflation could encourage a more hawkish policy approach from the Fed.”

For more insights on trucking industry dynamics and economic outlooks, subscribe to FreightWaves’ newsletters and stay updated with the latest trends and analyses.

The post Inflation fears, housing prices startle consumers appeared first on FreightWaves.