This week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Last week’s FreightWaves Supply Chain Pricing Power Index: 25 (Shippers)

Three-month FreightWaves Supply Chain Pricing Power Index Outlook: 35 (Shippers)

The FreightWaves Supply Chain Pricing Power Index uses the analytics and data in FreightWaves SONAR to analyze the market and estimate the negotiating power for rates between shippers and carriers.

This week’s Pricing Power Index is based on the following indicators:

Low tide for trucking industry

This column tends to focus on domestic truckload markets and their influences from the macroeconomy, but it is also important to consider a key conduit of freight into these markets: namely, ocean import volumes. Unfortunately but unsurprisingly, the container shipping industry is suffering similar ailments of weakened demand and a protracted deterioration of carrier rates. While ocean carriers are not facing the same risks as their domestic trucking counterparts, given their great consolidation and enormous war chests, this weakness in demand will continue to trickle down into and weigh on truckload markets.

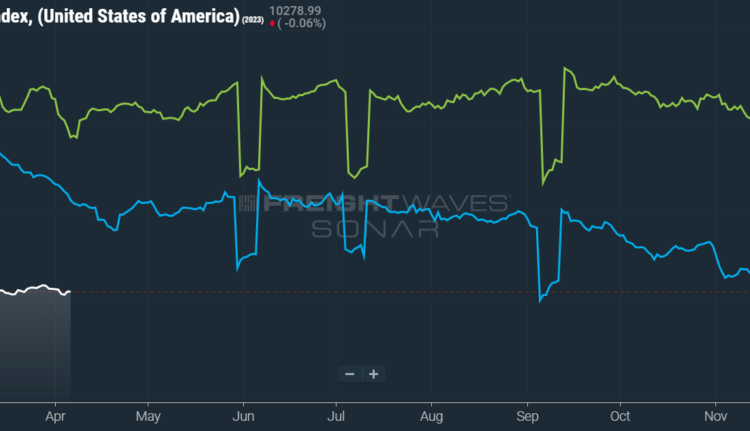

Tender volumes are well below year-ago levels:

SONAR: OTVI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

This week, the Outbound Tender Volume Index (OTVI), which measures national freight demand by shippers’ requests for capacity, fell 0.82% on a week-over-week (w/w) basis. On a year-over-year (y/y) basis, OTVI is down 19.1%, although such y/y comparisons can be colored by significant shifts in tender rejections. OTVI, which includes both accepted and rejected tenders, can be artificially inflated by an uptick in the Outbound Tender Reject Index (OTRI).

Accepted volumes are outpaced by 2021 and ’22:

SONAR: CLAV.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Contract Load Accepted Volumes (CLAV) is an index that measures accepted load volumes moving under contracted agreements. In short, it is similar to OTVI but without the rejected tenders. Looking at accepted tender volumes, we see a slight dip of 0.65% w/w as well as a fall of 11.4% y/y. This y/y difference confirms that actual cracks in freight demand — and not merely OTRI’s y/y decline — are driving OTVI lower.

Key metrics of U.S. ocean import activity are troubling at present. Bookings are down in an unseasonable way, as the volume of twenty-foot equivalent units being booked has fallen 48.5% y/y. Port pair delays from all ports abroad to all U.S. ports are currently averaging just over three days, down from nearly nine days one year ago. This rapid decline shows just how much port congestion has cleared globally. It’s difficult to even imagine the degree to which container rates have fallen: Global rates, according to the Freightos Baltic Daily Index, are down 99.8% y/y. Rates from China to U.S. ports on the West Coast are impossibly down even further — 99.9% y/y.

Despite these massive headwinds, container lines continue to be flush with cash and are still adding to their capacity, buying ships both new and extremely aged. This stability was brought about by staggering profits over the past couple of years and a reasonable forewarning of the current downturn, allowing carriers to minimize their leverage ratios and post strong balance sheets.

The tanker side of the market, however, recently found a stumbling block after OPEC+, the powerful coalition of oil-producing countries unofficially led by Saudi Arabia, cut its production quotas by roughly 1% of global oil demand. This move, intended to combat plummeting oil prices in March following threats of a global banking crisis, sent prices shooting up 8%. The central question is whether OPEC+ cut production because it earnestly believed that oil demand was weakening in the face of a global recession or whether the cartel is simply trying to manipulate prices for its short-term benefit. Either option is bad news for tankers, though the latter should only depress the tanker market for a little while.

Markets see slim pickings this week:

SONAR: Outbound Tender Volume Index – Weekly Change (OTVIW).

To learn more about FreightWaves SONAR, click here.

Of the 135 total markets, 47 reported weekly increases in tender volume, although most of the larger markets suffered w/w declines.

Freight demand fell violently in Texas’ border market of El Paso, with the market’s local OTVI dropping 11.23% w/w. This decline is somewhat expected, given that carriers in the region experienced heavy delays at the U.S.-Mexico border due to computer glitches on both sides. That said, El Paso is not nearly as important for outbound volume as are Texas’ other cross-border markets of Laredo and McAllen.

By mode: Reefer volumes are putting up an unseasonably poor performance, even though produce season — which begins in Texas and Florida — should be driving reefer demand higher. The Reefer Outbound Tender Volume Index (ROTVI) fell a staggering 5.34% w/w, drastically underperforming against the overall OTVI. As has been mentioned before, produce season will not see any significant gains once California joins the fray, given that the state has suffered disruptive late-winter storms that have reduced the yields on many of California’s crops.

Dry van volumes, on the other hand, are middling but are outperforming the overall OTVI. The Van Outbound Tender Volume Index (VOTVI) is down a slim 0.19% w/w. With both the current and expected weakness in consumer demand, it is unlikely that VOTVI will see any uptick in the foreseeable future.

Carriers walking on the razor’s edge

Capacity could hardly be looser as OTRI just dropped below 3%. The wide spread between contract and spot rates continues to be a sufficient incentive for carriers to cling to their contracted loads. Whenever contract rates are substantially higher than spot rates, a cyclical reaction forms that effects lower tender rejections, since lower tender rejection rates lead to fewer loads falling to the spot market, which in turn causes spot rates to cool and carriers to comply along their contracted lanes more readily.

OTRI reveals overabundance of capacity in the market:

SONAR: OTRI.USA: 2023 (white), 2022 (blue) and 2021 (green)

To learn more about FreightWaves SONAR, click here.

Over the past week, OTRI, which measures relative capacity in the market, fell to 2.98%, a change of 16 basis points (bps) from the week prior. OTRI is now 917 bps below year-ago levels, putting it closer than ever to its pandemic-induced floor.

Truckers Integral to our Economy (TIE), a new trucking trade group, has been formed with the express purpose of protecting the classification of eligible owner-operators as independent contractors at a federal level. This classification was, perhaps most notably, the center of a debate raging over California’s AB5 law, which categorizes owner-operators that are under lease agreements with established carriers as employees, not independent contractors. Of course, if such an owner-operator is classified as an employee, the carrier would be required to provide benefits like health insurance, while the owner-operator’s flexibility in choosing or rejecting loads would be severely constrained.

Although TIE is not seeking to join any battles at the state level, the Department of Transportation recently proposed a law that has the potential to similarly narrow the definition of an independent contractor. I say “potential” because DOT’s proposal is frustratingly vague in its effects on the trucking industry, though it suggests that if a carrier enforces safety standards with its leased owner-operators (such as installing cameras in one’s truck), it could be interpreted as a sign of “exerting control” in the manner of an employer. At present, TIE’s primary mission is to prevent or delay DOT’s implementation of this proposal, which is otherwise likely to roll out by early summer.

Capacity was widely available this week:

SONAR: WRI (color)

To learn more about FreightWaves SONAR, click here.

The map above shows the Weighted Rejection Index (WRI), the product of the Outbound Tender Reject Index — Weekly Change and Outbound Tender Market Share, as a way to prioritize rejection rate changes. As capacity is generally finding freight this week, no regions posted blue markets, which are usually the ones to focus on.

Of the 135 markets, 53 reported higher rejection rates over the past week, though 27 of those saw increases of only 100 or fewer bps.

SONAR: VOTRI.USA (white); ROTRI.USA (green); FOTRI.USA (orange)

To learn more about FreightWaves SONAR, click here.

By mode: Flatbed rejection rates, though spared a third week of consecutive drops, continue to betray weakness in the sector. The Flatbed Outbound Tender Reject Index (FOTRI) saw a gain of 129 bps w/w, putting FOTRI back into the double digits at 11.13%. Despite FOTRI’s volatile swings over the past year, it is unlikely that the index will see any great resurgence on the near horizon since the industrial economy is succumbing to recessionary headwinds.

As for the other modes, rejection rates could hardly be worse. The Reefer Outbound Tender Reject Index (ROTRI), as should be expected from ROTVI’s poor performance, is down 41 bps w/w to 3.3%. This current reading marks ROTRI’s lowest level by far in the data set, which stretches back to 2018. The Van Outbound Tender Reject Index (VOTRI) similarly fell 18 bps w/w, dipping below 3% once again to 2.83%.

Margins are getting slim, fast

The aforementioned OPEC+ production cuts have yet to arrest the protracted fall of diesel prices, at least according to the latest weekly release from the Department of Energy. Diesel prices will almost certainly rise soon, however. The bad news for spot market carriers is that, since Russia’s full-scale invasion of Ukraine in February 2022, gasoline and diesel prices have proven to be much, much stickier than those of oil. When diesel prices inevitably rise, it is likely that they will remain elevated even if crude prices drop in the next month or two. In an ideal world, higher operating costs would demand higher carrier rates, but — with the PPI now sitting at 25 — carriers lack the pricing power needed to force rates upward.

Impossibly, spot rates find further room to fall:

SONAR: National Truckload Index, 7-day average (white; right axis) and dry van contract rate (green; left axis).

To learn more about FreightWaves SONAR, click here.

This week, the National Truckload Index (NTI) — which includes fuel surcharges and other accessorials — fell 1 cent per mile to $2.29. Linehaul rates were largely in line with this lack of movement. The linehaul variant of the NTI (NTIL) — which excludes fuel surcharges and other accessorials — held steady at $1.64.

Contract rates, which exclude fuel surcharges and other accessorials like the NTIL, are largely exempt from the drama surrounding diesel prices since fuel costs are often a pass-through for carriers running contracted loads. This week, contract rates rose 1 cent per mile and remain far more stable than spot rates, given the average length of shippers’ bid cycles. Contract rates, which are reported with a two-week delay, currently sit at a national average of $2.53 per mile. Weekly rises and falls should not be given much consideration until data comes in from mid- to late March, when the effects of Q2’s requests for proposals will be seen.

SONAR: RATES.USA

To learn more about FreightWaves SONAR, click here.

The chart above shows the spread between the NTIL and dry van contract rates, revealing the index has fallen to all-time lows in the data set, which dates to early 2019. Throughout that year, contract rates exceeded spot rates, leading to a record number of bankruptcies in the space. Once COVID-19 spread, spot rates reacted quickly, rising to record highs on a seemingly weekly basis, while contract rates slowly crept higher throughout 2021.

Despite this spread narrowing significantly over the first few weeks of the year, tightening by 20 cents per mile in January, it has continued to widen again. Since linehaul spot rates remain 86 cents below contract rates, there is still plenty of room for contract rates to decline over the coming months.

SONAR: FreightWaves TRAC rate from Los Angeles to Dallas.

To learn more about FreightWaves TRAC, click here.

The FreightWaves TRAC spot rate from Los Angeles to Dallas, arguably one of the densest freight lanes in the country, took a brutal tumble to new record lows. Over the past week, the TRAC rate fell 8 cents per mile to $1.81, a far cry from its year-to-date high of $2.39. The daily NTI (NTID), which sits at $2.28, is handily outpacing rates from Los Angeles to Dallas.

SONAR: FreightWaves TRAC rate from Atlanta to Philadelphia.

To learn more about FreightWaves TRAC, click here.

On the East Coast, especially out of Atlanta, rates remained more stable but are also outpaced by the NTID. The FreightWaves TRAC rate from Atlanta to Philadelphia slid 2 cents per mile w/w to $2.27. Except for Q4’s holiday run, rates along this lane have been dropping stepwise since July 2022, when the TRAC rate was $3.48 per mile.

For more information on FreightWaves’ research, please contact Michael Rudolph at mrudolph@freightwaves.com or Tony Mulvey at tmulvey@freightwaves.com.

The post No motion in the ocean (markets) appeared first on FreightWaves.