(An article with a table for key Ryder performance indicators can be found here.)

Ryder System expects to conclude 2024 as a company that in six years has steadily and inexorably changed itself from what it was and probably still is mostly known for — truck rentals — into a transportation offering where contractual business is increasingly the base of its operations.

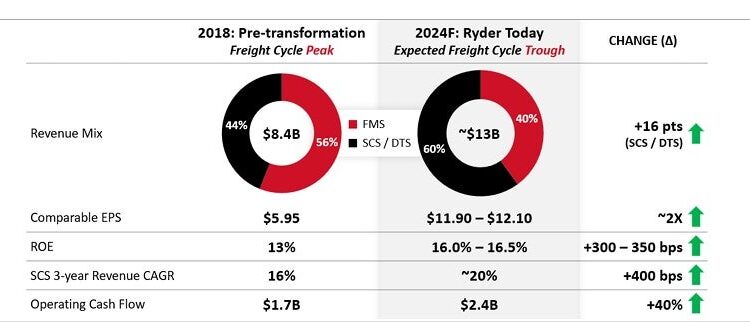

That fact has been pushed by Ryder (NYSE: R) management in various presentations for several years. But it was driven home further in its third quarter earnings report and call with analysts by a chart that compared the Ryder of 2018 with the Ryder of today.

In a graph that described the Ryder of six years ago as “pre-transformation,” 56% of the company’s $8.4 billion in revenue came from its Fleet Management Services (FMS) division, the unit whose ubiquitous trucks on the road are rolling billboards for its truck rental activities. The remaining 44% came from the combined operations of Supply Chain Solutions (SCS), which is mostly a contract logistics provider, and Dedicated Transport Solutions (DTS) segment, which provides dedicated transportation for contract customers.

It has taken several years, but this year that split is expected to be about 60% SCS/DTS and FMS holding the balance.

The benefit, according to Ryder CEO Robert Sanchez on the phone call, is that the SCS/DTS business is more contractually-based, leading to more predictable revenue streams and earnings.

By one key measure, it wasn’t a particularly strong quarter at Ryder. Non-GAAP earnings per share were $3.44 compared to $3.58 in the third quarter of 2023. But revenue was up to $2.6 billion, aided by two acquisitions, Cardinal Logistics in DTS and Impact Fulfillment Services in SCS.

But free cash flow rose to $218 million from $32 million a year ago. Return on equity of 16%, although down from 21% a year ago, was “in line with our expectations given where we are in the freight cycle,” Sanchez said.

The earnings call focus

But it was the shift to more contractual revenue that Sanchez wanted to focus on during the call. “Our contractual businesses continue to perform well, demonstrating the enhanced quality of our portfolio and increased resilience,” he said. “The earnings power of our contractual portfolio is providing us with increased capital deployment capacity, which we expect to use to support profitable growth and return capital to shareholders.”

He also predicted that the fourth quarter would be the first since the fourth quarter of 2022 where year-on-year net income would be higher.

Used vehicle prices still matter

But the Ryder business has not changed so much that the price of used vehicles is less important to its bottom line. The bad news for Ryder is that its sales have slowed and the price it is obtaining in sales continues to drop. The good news from a financial perspective is that the prices it is getting are more than the residual values already baked into depreciation, according to executives on the call.

Ryder’s FMS division sold 4,700 vehicles in the third quarter. That’s down from 6,000 in the second quarter and 6,500 a year ago.

Ryder does not provide an average price; it would be largely pointless because it would be one average number for an enormous cross-section of vehicle types. But it did report that its proceeds were down 12% for tractor sales from the second quarter but up 4% for trucks. The corresponding figures for the 3Q 2023 comparison were down 19% for trucks and 22% for tractors.

Inventories still high

At the close of the third quarter, the used vehicle inventory at Ryder was 9,100 vehicles, which it noted as “slightly above (the) 7-9k target range.” But the inventory was down from the 9,500 at the end of the second quarter but significantly more than the 7,800 at the end of the third quarter of 2023.

Havens conceded it “has been a relatively slow sales year, when we get to the renewal stages of the leases.” The downsizing might show up as a customer that had 10 units instead choosing to renew only nine, Havens said.

In response to a question about pricing, Havens did not offer any specifics. But he said he would “reiterate some points that we’ve made in the past, that we have a compelling value prop when you compare it to ownership. We’re well positioned to deal with inflationary pressures. We have to sell that.”

While the earnings call may have been forward-looking, stock market reaction Thursday was strongly bearish, though the non-GAAP EPS of $3.44 was 2 cts/share better than Wall Street consensus. At approximately 2:15 p.m. Ryder was down 5.64%, or $8.18, to $136.85.

But Ryder also issued a forecast for the rest of the year that was slightly bearish. Its full year earnings per share is now predicted to hit $11.10-$11.30 on a GAAP basis. At the end of the second quarter, that figure was $11.15-$11.65.

More articles by John Kingston

TFI’s Bedard: Buying UPS’ LTL operations was not a mistake

Manhattan Associates’ growing supply chain problem: Slow-closing software deals

Marten’s earnings and almost all other key operating metrics down

The post Less reliance on rentals, more on contracts: Ryder continuing its mission appeared first on FreightWaves.