For U.S.-Mexico trade, Tesla Inc. could prove to be the gift that keeps on giving.

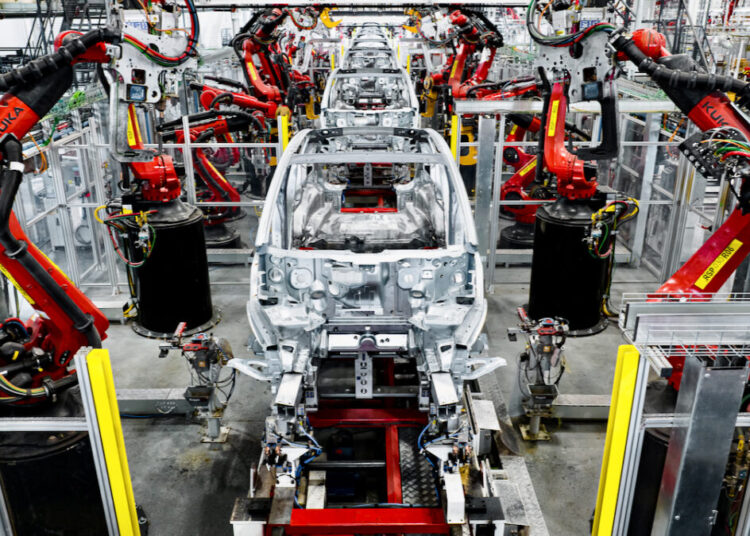

With the automaker recently confirming that it’s building a $5 billion factory in the northern Mexican city of Monterrey, trade experts said Tesla is already influencing cross-border logistics and trucking.

“Tesla’s impact on Mexico can already be felt long before they actually open their Mexico gigafactory,” Jordan Dewart, president of logistics operator Redwood Mexico, told FreightWaves. “After Tesla’s move to Austin two years ago, many of their tier 1 and tier 2 suppliers either moved to Mexico to start new factory operations, or greatly increased the size and scope of current operations.”

Dewart expects Tesla’s upcoming Mexico factory to impact everything from northbound and southbound trucking rates to demand for industrial logistics space near the border.

The plant will be located in the municipality of Santa Catarina, near Monterrey, about 136 miles from the U.S-Mexico port of entry in Laredo, Texas. The facility is expected to create up to 6,000 jobs in its first phase and aims to produce 1 million electric vehicles a year. It is scheduled to open in 2024.

“The Tesla plant is going to cause much more freight between Texas and Mexico,” said Jorge Canavati, a principal at San Antonio-based trade and logistics firm J. Canavati & Co. “In Monterey, you have various Tesla suppliers already there and there are going to be more. The regional impact is going to be just amazing.”

Tesla’s Monterrey factory accelerating Mexico’s nearshoring boom

Once Tesla’s Monterrey factory comes online, it could boost the number of automotive suppliers it has in Mexico by four times more than the current total of around 127, according to officials.

Tesla’s suppliers in Mexico are concentrated in the country’s northern states along the U.S. border, shipping parts and components to the automaker’s electric car factory in Austin, Texas.

“The [factory in Monterrey] means a great step for Mexico in several ways,” Martha Delgado Peralta, Mexico’s undersecretary of foreign affairs, recently said in Reforma. “We would be encouraging an ecosystem of electric vehicles and raising our levels of exports to the United States by 3.5% annually, equivalent to a sum of $15 billion, representing a 10% increase in auto-related exports.”

Tesla (NASDAQ: TSLA) was founded in 2003. The company designs and manufactures electric vehicles, battery energy storage products and solar panels.

Tesla moved its headquarters to Austin from Palo Alto, California, in 2021. The company last year opened its 10 million-square-foot Gigafactory Texas in Austin, where it produces its Model Y vehicle and is the future production location of the upcoming Cybertruck.

Foreign companies with ties to Tesla recently announcing new plants or expanding existing plants in Mexico include China-based Noah Itech, which recently broke ground on a $100 million production facility in Santa Catarina. The firm provides automation technology for automakers.

Belgium-based AGP Group, which supplies glass to Tesla, also recently announced it is investing $800 million in a new facility in Santa Catarina, according to Mexico Now.

Jay Gerard, head of customs for Nuvocargo, said due to shifting global supply chains, he has seen growth in demand over the last several years for Mexico cross-border services, combined with the growing trend of nearshoring.

“Shippers will continue to diversify their supply chain away from Asia with a focus on Mexico for both manufacturing and raw materials,” Gerard told FreightWaves. “Shippers will also look to explore the United States-Mexico-Canada Agreement and take advantage of it.”

New York-based Nuvocargo is a digital logistics platform for cross-border trade between the U.S. and Mexico.

With the aim of tapping into the influx of new companies nearshoring to Mexico, Nuvocargo recently launched Nuvo Customs, a service aimed at streamlining customs operations and reducing crossing times for freight, especially at ports of entry such as Laredo.

Gerard said all of the companies nearshoring to Mexico should work with logistics providers and customs brokers that will be able to scale and grow with their company.

“Find companies with expertise on both sides of the border that are subject matter experts on the Mexico freight and border operation as well as the U.S. operation,” Gerard said. “Look for true partners that will push the supply chain to be seamless and faster.”

Big opportunities for carriers to expand in Texas and Mexico

As Tesla starts to ramp up electric vehicle assembly at its Monterrey plant, expect a huge influx of freight in the region, said Matt Silver, vice president of cross-border solutions at Austin-based Arrive Logistics.

Arrive Logistics is a multimodal transportation and technology company with over 6,000 customers and 70,000 carriers in its network.

“Anytime there’s a new company that’s building a plant in Mexico, it’s good for trade between Mexico, the U.S. and Canada,” Silver said. “Ultimately, when you have a big OEM build a new plant in Mexico, especially somewhere like Monterrey, one of the largest shipping points in Mexico, it’s advantageous as a shipper to go there.”

Silver said Monterrey is already a market location where carriers are always looking for freight to haul, but the arrival of the Tesla plant could dramatically increase demand for trucking services.

“When you have an OEM come into a place like Monterrey, that’s going to take up capacity,” SIlver said. “OEMs are notorious for having a lot of volume, so that typically draws carriers to it. Carriers will actually often go build a network around shippers often. I’ve seen this happen in the past.”

The plant in Monterrey could create a cascade effect in which Tesla continues to load carriers with more and more freight to ship cross-border.

“Carriers will go buy more trucks and more trailers, and we actually see carriers grow their business with us because of that,” Silver said. “I think you’ll see the same thing happening with an OEM like Tesla building out a plant in Monterrey.”

Dewart said one of the downsides of the Tesla factory could be an even greater imbalance of northbound and southbound trucking capacity along the border. The disparity between northbound and southbound trucks from Mexico has been an issue for years, and could worsen once the Monterrey factory opens.

“The impact unfortunately has been and will be a large demand for northbound equipment on an already strained Mexican cross-border transportation market,” Dewart said.

Tesla currently hosts many U.S.-based suppliers, and the near-term effect on capacity may be neutral with large amounts of inbound component parts, however “the midterm effect will undoubtedly be to absorb more empty trailers than it brings in,” Dewart said.

“I have spoken with many carriers that service the Monterrey, Mexico, to central Texas corridor and it is a foregone conclusion that the trip is rated as a round trip, considering they will come back empty 400 or 500-plus miles in order to deliver just-in-time service levels,” he said.

Changing perception of Texas-Mexico supply chains

Canavati said Texas and Mexico stand to benefit hugely from the Tesla factory in Monterrey, as well as the company’s other plans throughout the Lone Star State.

Tesla recently announced a $775 million expansion of its Gigafactory Texas in Austin, building a cathode facility, cell test lab, die shop, drive unit facility and more.

The company also recently told investors it had broken ground on a lithium refinery near Corpus Christi, Texas, with plans to begin producing battery-grade lithium products for electric vehicles by the end of the year.

“You’re going to see more logistics services — rail, air cargo, trucking — you’re going to have more foreign direct and domestic investment in Texas and in Mexico,” Canavati said.

Canavati said the USMCA and nearshoring are also helping to change outdated concepts about Mexico.

“We’re seeing companies say, ‘We’re in Mexico because they have a good workforce, we’re in Mexico because there’s good supply chain fundamentals, because we’re close to a major supplier, close to a major customer,’” Canavati said. “There’s confidence in the country.”

Watch: Truckload carrier U.S. Xpress being acquired by Knight-Swift.

Click for more FreightWaves articles by Noi Mahoney.

More articles by Noi Mahoney

Borderlands: Truck driver salaries in Mexico averaged $4,400 in 2022

Manitoba aims to keep ‘chameleon carriers’ off Canadian roads

Borderlands: Mexico starts 2023 as top US trade partner

The post Tesla’s arrival in Mexico could boost cross-border trade by $15B appeared first on FreightWaves.