South Korean ocean carrier HMM’s second-quarter net profit plunged 89% year over year.

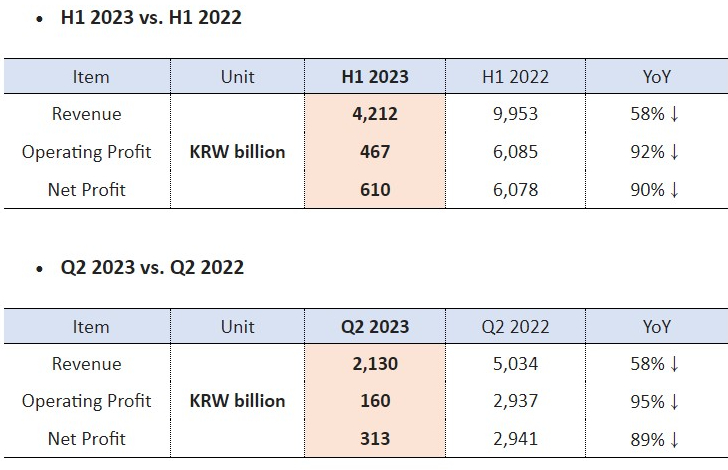

HMM provides little color in its earnings releases and reports in South Korean won. It reported Thursday that Q2 net profit was KRW 313 billion ($238 million), compared to KRW 2.9 trillion ($2.2 billion) in the second quarter of 2022.

Operating profit plummeted 95% year over year, from KRW 2.93 trillion ($2.2 billion) to KRW 160 billion ($121.8 million). Revenue dropped 58%, from KRW 5.03 trillion ($3.8 billion) in Q2 of last year to KRW 2.1 trillion ($1.6 billion) this year.

HMM attributed much of the downfall to overcapacity in the container shipping industry, “mainly led by the influx of new containerships ordered during the pandemic and supply chain normalization at major ports and inland regions. The cascading effect of larger vessels from the main east-west trades to smaller lanes intensified the imbalance between supply and demand.”

Net profit has been in a free fall all year. HMM reported a year-over-year first-half net profit dive of 90%, from KRW 6.07 trillion ($4.6 billion) in the first six months of 2022 to KRW 610 billion ($464 million). Similarly, operating profit dropped 92%, from KRW 6.08 trillion ($4.6 billion) to KRW 467 billion ($354 million). First-half revenue was down 58%, from KRW 9.9 trillion ($7.5 billion) to KRW 4.21 trillion ($3.2 billion).

HMM said freight rates in most key trade lanes were under “downward pressure” in the first half of the year.

“The Shanghai Containerized Freight Index (SCFI) in H1 2023 was 976 points on average, significantly down 78% from 4,504 points in H1 2022,” it said.

HMM maintained that its financial structure has remained strong. “HMM’s debt-to-equity ratio slightly improved to 24% in June 2023 from 26% in December 2022.”

Looking ahead in the trans-Pacific trade, HMM said it expects “a gradual recovery in cargo volumes as a rebound in inventory restocking and a soft landing for the U.S. economy are likely to come to fruition, with no drastic changes in the supply side in the near term.”

The post HMM hit by ‘intensified’ imbalance between supply and demand appeared first on FreightWaves.