The increase posted Monday in the benchmark diesel price used for most fuel surcharges could be seen as historic.

By one measure, it isn’t a big deal. The 9.9-cent increase in the Department of Energy/Energy Information Administration average weekly retail diesel price to $3.905 a gallon is only the 9th biggest since Russia invaded Ukraine in February 2022, including that period a few weeks before actual military action began and the market was reacting to the possibility of war.

But the volatility of the past 17 to 18 months is an aberration, a one-time incident when the world was sanctioning Russian crude and diesel supplies and prices were reacting accordingly. The reaction to that took the DOE/EIA price to a high of $5.81 a gallon in June 2022 from $3.613 at the start of that year.

The long start-and-stop slide in oil and diesel prices since then most recently saw a 22-week period in which the price dropped 20 times. But prices in the past three weeks have risen 13.8 cents a gallon, getting there through a combination of a 3.9-cent rise two weeks ago, followed by an unchanged week and now the 9.9-cent increase.

In the 10 years leading up to the Russian invasion of Ukraine, the DOE/EIA price exceeded 9.9 cents a gallon for a weekly gain just three times. Two times were at the same time as significant hurricane activity in the Gulf of Mexico; a third was when markets were starting to react strongly bullish in early 2021 to the global economy emerging from the fog of COVID.

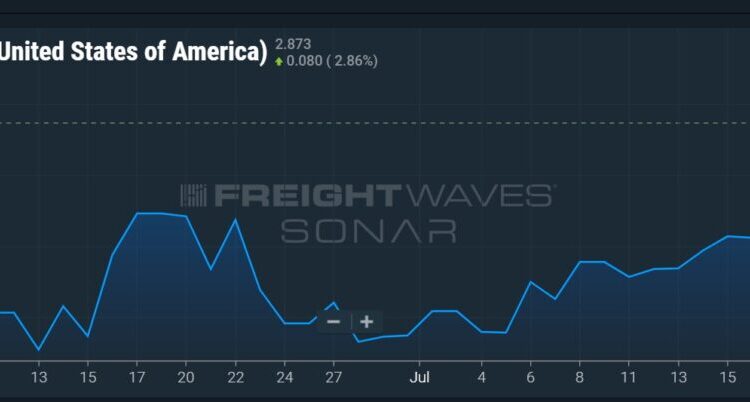

All the conditions were in place for the size of the move posted Monday. The wholesale price of ultra low sulfur diesel (ULSD), as measured by the ULSDR.USA data series in SONAR, rose more than 30 cents a gallon between June 28 and this past Saturday.

But the spread between wholesale and retail prices as measured by the FUELS.USA data series in SONAR plummeted steadily during that time for the U.S. as a whole. It was $1.615 a gallon on May 4 and was down to $1.042 a gallon on Sunday, according to the data series. That number was the lowest since October, when diesel futures and wholesale prices were moving rapidly higher on the back of extremely tight inventories going into winter.

With retail prices being lagging indicators — which is visible in the FUELS.USA spread — it sets up the prospect of retail diesel continuing to move higher in the coming days and weeks unless futures and wholesale markets take a sudden reversal.

The price of ultra low sulfur diesel on the CME commodity exchange, with a 2.4-cents-a-gallon increase on Monday to $2.7705 a gallon, has gained 20.63 cents in the past five trading days. The Monday settlement was the highest since March 27.

Combine that increase in the outright level of the key commodity market for diesel with the fact that retail prices have been reacting slowly on the way up and further price gains are likely ahead.

Additionally, after several weeks during which the price of diesel on the futures market has moved at about the same pace as the price of crude, diesel has suddenly exploded higher in the past few trading days.

A comparison of the front month price of Brent to ultra low sulfur diesel on CME sees the spread hold steady at about 65 to 70 cents a gallon for the final week of June and much of the first three weeks of July. But that spread has moved up above 80 cents a gallon in the past few trading days.

More articles by John Kingston

TriumphPay records progress on profitability in tough quarter

Uber Freight lays off as many as 50 brokerage employees

Monthly Cass report suggests freight market bottom may be near

The post 1-week move in benchmark diesel price part of broad market increase appeared first on FreightWaves.